May 29, 2024

Empathy 2.0: How gen AI and data are shaking up debt-collection

Americans are sliding deeper into debt, which means new work and new challenges for debt collectors. How AI debt collection and empathy are remaking the business of debt recovery.

In an economy troubled by inflation and fears of recession, the steady job market has provided a buffer for consumers against the rising cost of borrowing money.

But now consumers’ debt burden is growing. Credit card debt hit a record high in the final quarter of last year, mortgage balances topped $12.25 trillion (despite a decline in originations), while the average auto loan debt grew 5.2% in 2023.

For financial institutions and collection agencies, navigating the resulting rise in delinquencies requires tapping an unusual pair of resources—automation and empathy—and using data to unlock their combined power. By applying AI in debt collection, organizations can not only improve recovery rates, but build stronger customer relationships that over time translate to growth and competitive advantage.

Empathy meets AI in debt collection

The collection of debts has always been a fraught area of customer relations. But then—and you may have heard this before—came the Internet. Negative collection experiences go viral on TikTok. Online reviews wield enormous influence over buying decisions. And hardly anyone answers phone calls from unknown numbers.

Debt collection needed a new playbook—and along came AI.

Modern debt collectors know that friendly, flexible, solutions-oriented approaches to debt recovery work better than hardball tactics, and they’re exactly the kinds of personalized interactions that can now, suddenly, be automated and deployed at scale with gen AI and data. The more informed the debt collectors are about an individual customer’s payment challenges, the more creative and useful they can be in helping navigate a labyrinth of financial difficulty.

While we think of empathy as a uniquely human attribute, data can play a key role in making collections interactions (both automated and person-to-person) feel more empathetic. With advanced analytics, organizations can boost recovery rates through personalized engagement strategies that provide flexible repayment solutions based on individuals’ finances. Leveraging AI in debt collection and its vast reserves of data can also help debt collectors with messaging, timing, and tone—all of which are crucial to improving collection rates and customer experience. Better still, AI and machine learning systems can be regularly retrained, constantly improving their accuracy by incorporating new data and insights.

Focus on CX

Across the business landscape, data these days also plays a key role in shaping customer experience. Today’s consumers expect speed, flexibility, and personalized experiences. They’ve grown accustomed to platforms like Netflix that greet them by name and can predict their preferences with pinpoint accuracy.

By contrast, most collections’ operations still rely on decades-old processes. Banks and financial institutions often struggle with even simple predictions for debt recovery, with many unable to determine the likelihood of a customer making the next scheduled payment, or even to reliably keep track of customers’ preferred channels and contact times.

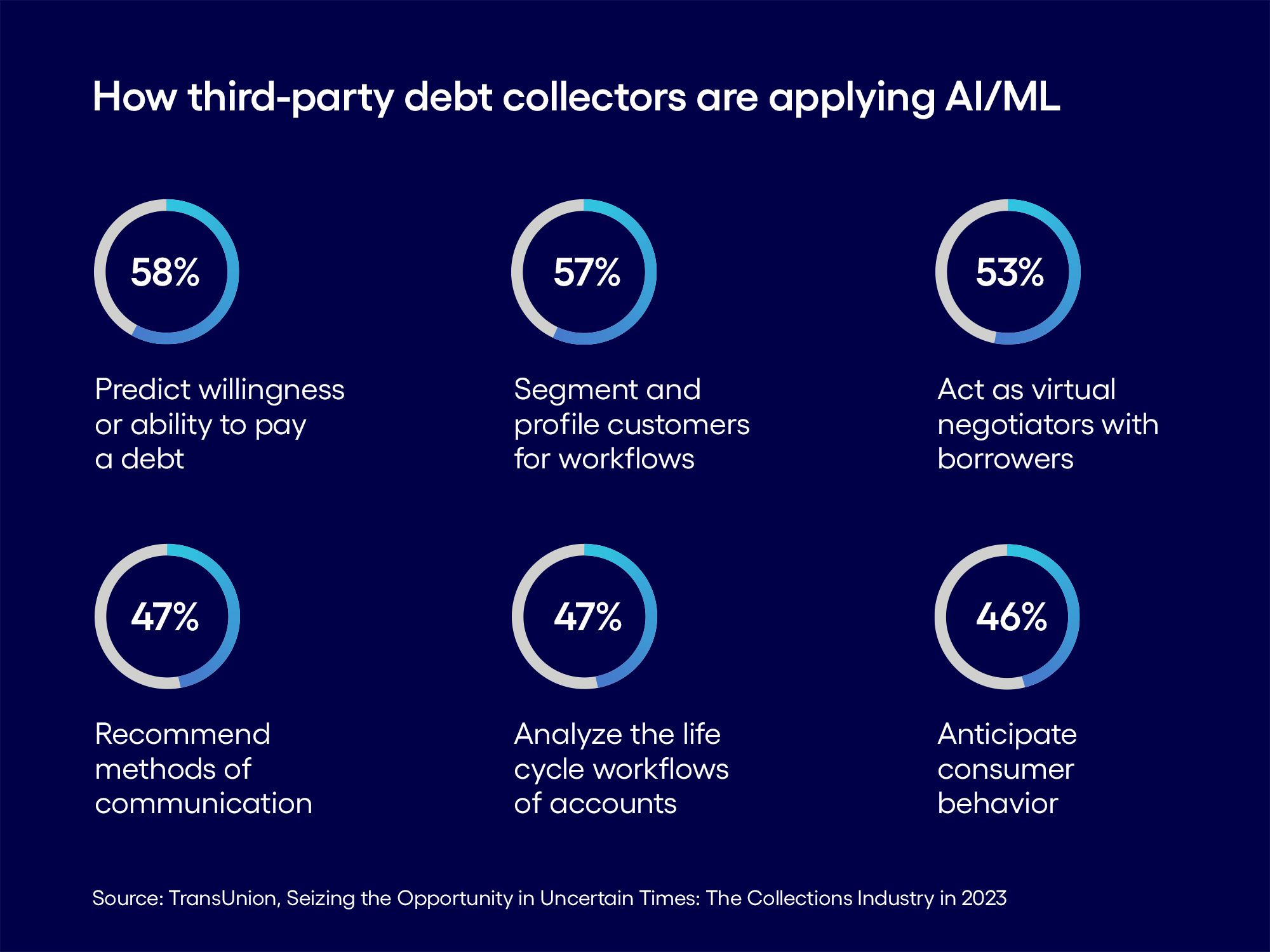

But AI/ML technologies are beginning to change all that. A 2023 survey of third-party collectors found 11% were already using AI/ML technologies and 60% were making plans to. The survey found that when asked how they’re deploying AI/ML technologies, third-party collectors indicated a variety of planned uses.

Figure 1

Where next-gen collections make the biggest difference

Among AI’s many possibilities, we recommend banks and collection agencies focus on the following areas for debt recovery automation for the greatest ROI:

- Enhanced segmentation. Dynamic risk segmentation creates more nuanced, behavior-based risk models. By leveraging lag indicators (account details and past payment history) and forward indicators (credit score and employment), dynamic segmentation predicts customer behavior far better than static models based on credit scores and missed payments.

- Personalization. It may seem counterintuitive, but automated debt management systems can sometimes come across as more empathic than their human counterparts. Because they draw on deep reserves of data. the large language models at the heart of generative AI enable banks and collection agencies to create payment plans tailored to individuals’ needs.

By using data and generative AI, and designing algorithms with predictive models, debt collectors can revisit their overall engagement strategy for collections, while bringing new insights and flexibility to the management of at-risk accounts.

- Customized contact strategy. Intelligent real-time language processing can generate conviction scores that complement propensity-to-pay scores (the likelihood a consumer will pay their bills). As a result, the early detection of willingness to pay (with intent confirmed through sentiment analysis) allows banks to identify debtor profiles and create effective contact strategies and targeted offers.

By leveraging AI in debt collection through automation and empathy in judicious combination, debt-collection organizations can maintain healthy financial portfolios in this changing, debt-laden world of 2024 beyond, while never compromising on customer care and experience.

For more information, read our blog Transforming auto finance: Gen AI’s path to modernization.

Renuka Kambli is an AVP within Cognizant Business Consulting’s Banking and Financial Services practice. She heads the Lending and Payments Consulting practice for North America. She has 18+ years experience and was recognized by Consulting Magazine 2022 as a Women Leader in Technology.

Latest posts

Related posts

Get actionable business Insights in your inbox

Sign up for the Cognizant newsletter to gain actionable AI advice and real-world business insights delivered to your inbox every month.