Scaling digital twins with AI for smarter manufacturing operations

Intuitive, real-time visualizations let manufacturing and warehouse managers model changes without downtime.

Discover industry-specific solutions and expertise.

Solve your toughest A&D challenges with Belcan.

Ignite peak performance and efficiency in your business.

Reimagine your manufacturing competitive advantage.

Accelerate growth with customer-focused solutions.

Our data and AI solutions align with your business outcomes and create impactful results.

Personalize learning experiences with education tech and IT solutions—and make learners feel valued.

Create strategies for product, service and process innovation that deliver new growth.

Meet customer demands for a digital, personalized online insurance experience—while reducing risk.

Digitally transform to empower a more intelligent, agile and high-performing enterprise.

Make business decisions based on real-time contextual data with our digital solutions.

Stay ahead of the competition with the latest tech like IoT, machine learning and blockchain.

Deep industry expertise to propel your business into the future.

Explore Belcan’s flexible, custom-tailored solutions.

Put AI to work and turn opportunity into value.

Accelerate time to value for industrial edge AI.

Maintain high integrity across the AI lifecycle.

Realize the next frontier of enterprise performance.

Enhance operations, boost efficiency, remove technical debt and modernize apps for the future.

Operate with insight and speed—using AI-powered processes that supercharge performance.

Boost operational efficiency, optimize costs and speed product development.

Reimagine the customer experience, attract and retain top talent, and win in the digital economy.

Sense change, optimize operations and mitigate risk with data-driven insights at quantum speed.

Enable a more secure and value-centered business with proven next-gen solutions.

AI insights to inspire enterprise transformation.

Understand and anticipate the needs of AI-empowered customers.

Invest in people to unlock the power of AI.

Bridge the gap between strong AI leadership and business readiness.

Explore the future of business with our Gen AI insights.

Explore the top focus areas that are important to Cognizant and our clients.

Dive into our forward-thinking research and uncover new tech and industry trends.

Check out our other insights and research—and the experts behind them.

Explore how our expertise can help you sense opportunities sooner and outpace change.

Discover industry-specific solutions and expertise.

Solve your toughest A&D challenges with Belcan.

Ignite peak performance and efficiency in your business.

Reimagine your manufacturing competitive advantage.

Accelerate growth with customer-focused solutions.

Our data and AI solutions align with your business outcomes and create impactful results.

Personalize learning experiences with education tech and IT solutions—and make learners feel valued.

Create strategies for product, service and process innovation that deliver new growth.

Meet customer demands for a digital, personalized online insurance experience—while reducing risk.

Digitally transform to empower a more intelligent, agile and high-performing enterprise.

Make business decisions based on real-time contextual data with our digital solutions.

Stay ahead of the competition with the latest tech like IoT, machine learning and blockchain.

Deep industry expertise to propel your business into the future.

Explore Belcan’s flexible, custom-tailored solutions.

Put AI to work and turn opportunity into value.

Accelerate time to value for industrial edge AI.

Maintain high integrity across the AI lifecycle.

Realize the next frontier of enterprise performance.

Enhance operations, boost efficiency, remove technical debt and modernize apps for the future.

Operate with insight and speed—using AI-powered processes that supercharge performance.

Turn big visions into practical realities with expertise that takes you further.

Boost operational efficiency, optimize costs and speed product development.

Reimagine the customer experience, attract and retain top talent, and win in the digital economy.

Sense change, optimize operations and mitigate risk with data-driven insights at quantum speed.

Enable a more secure and value-centered business with proven next-gen solutions.

Turn sustainability commitments into achievable milestones.

AI insights to inspire enterprise transformation.

Understand and anticipate the needs of AI-empowered customers.

Invest in people to unlock the power of AI.

Bridge the gap between strong AI leadership and business readiness.

Explore the future of business with our Gen AI insights.

Keep up with the trends shaping the future of business—and stay ahead in a fast-changing world.

Explore the top focus areas that are important to Cognizant and our clients.

Dive into our forward-thinking research and uncover new tech and industry trends.

Check out our other insights and research—and the experts behind them.

Explore how our expertise can help you sense opportunities sooner and outpace change.

May 29, 2024

Americans are sliding deeper into debt, which means new work and new challenges for debt collectors. How AI debt collection and empathy are remaking the business of debt recovery.

In an economy troubled by inflation and fears of recession, the steady job market has provided a buffer for consumers against the rising cost of borrowing money.

But now consumers’ debt burden is growing. Credit card debt hit a record high in the final quarter of last year, mortgage balances topped $12.25 trillion (despite a decline in originations), while the average auto loan debt grew 5.2% in 2023.

For financial institutions and collection agencies, navigating the resulting rise in delinquencies requires tapping an unusual pair of resources—automation and empathy—and using data to unlock their combined power. By applying AI in debt collection, organizations can not only improve recovery rates, but build stronger customer relationships that over time translate to growth and competitive advantage.

The collection of debts has always been a fraught area of customer relations. But then—and you may have heard this before—came the Internet. Negative collection experiences go viral on TikTok. Online reviews wield enormous influence over buying decisions. And hardly anyone answers phone calls from unknown numbers.

Debt collection needed a new playbook—and along came AI.

Modern debt collectors know that friendly, flexible, solutions-oriented approaches to debt recovery work better than hardball tactics, and they’re exactly the kinds of personalized interactions that can now, suddenly, be automated and deployed at scale with gen AI and data. The more informed the debt collectors are about an individual customer’s payment challenges, the more creative and useful they can be in helping navigate a labyrinth of financial difficulty.

While we think of empathy as a uniquely human attribute, data can play a key role in making collections interactions (both automated and person-to-person) feel more empathetic. With advanced analytics, organizations can boost recovery rates through personalized engagement strategies that provide flexible repayment solutions based on individuals’ finances. Leveraging AI in debt collection and its vast reserves of data can also help debt collectors with messaging, timing, and tone—all of which are crucial to improving collection rates and customer experience. Better still, AI and machine learning systems can be regularly retrained, constantly improving their accuracy by incorporating new data and insights.

Across the business landscape, data these days also plays a key role in shaping customer experience. Today’s consumers expect speed, flexibility, and personalized experiences. They’ve grown accustomed to platforms like Netflix that greet them by name and can predict their preferences with pinpoint accuracy.

By contrast, most collections’ operations still rely on decades-old processes. Banks and financial institutions often struggle with even simple predictions for debt recovery, with many unable to determine the likelihood of a customer making the next scheduled payment, or even to reliably keep track of customers’ preferred channels and contact times.

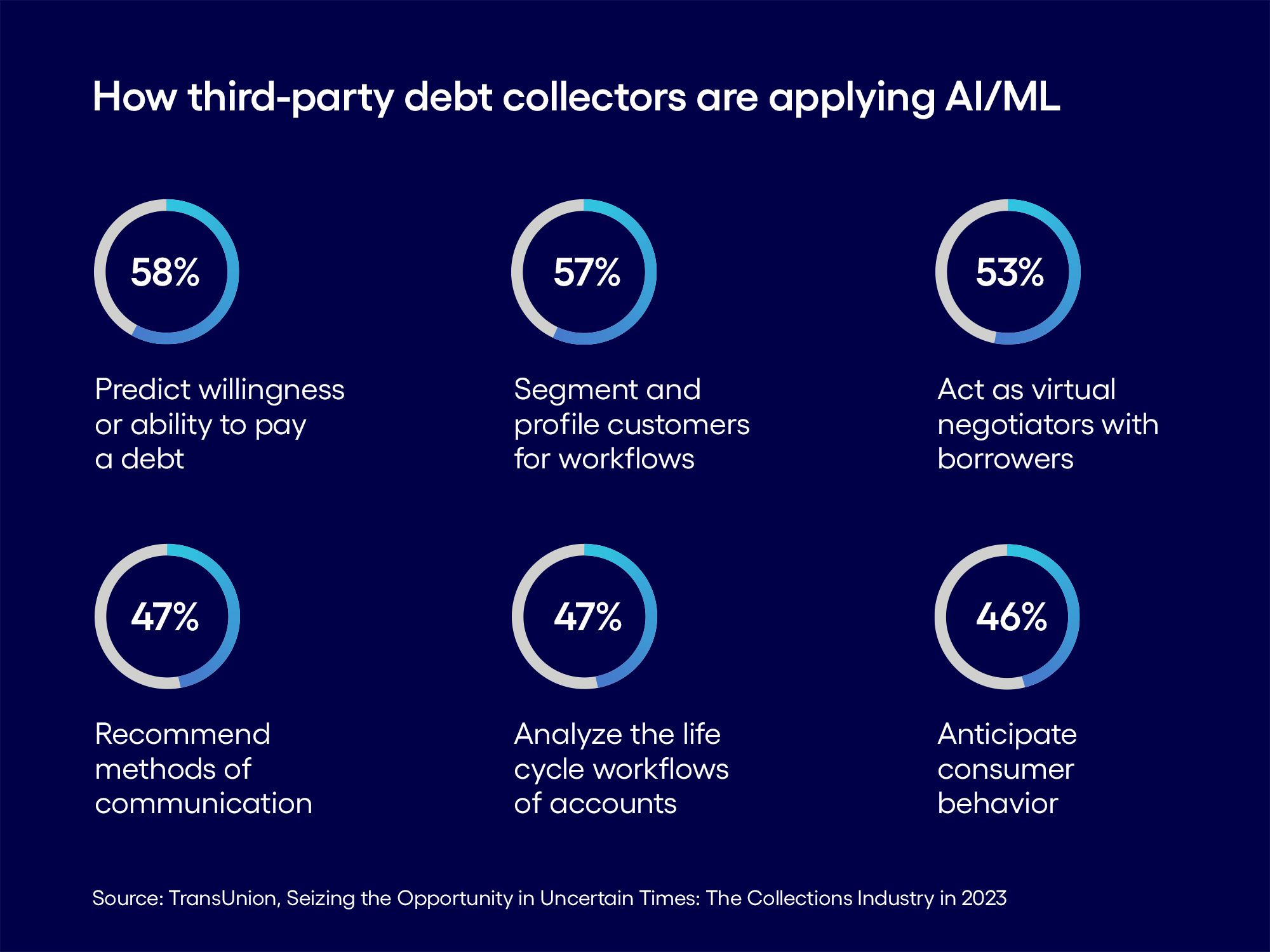

But AI/ML technologies are beginning to change all that. A 2023 survey of third-party collectors found 11% were already using AI/ML technologies and 60% were making plans to. The survey found that when asked how they’re deploying AI/ML technologies, third-party collectors indicated a variety of planned uses.

Figure 1

Among AI’s many possibilities, we recommend banks and collection agencies focus on the following areas for debt recovery automation for the greatest ROI:

By leveraging AI in debt collection through automation and empathy in judicious combination, debt-collection organizations can maintain healthy financial portfolios in this changing, debt-laden world of 2024 beyond, while never compromising on customer care and experience.

For more information, read our blog Transforming auto finance: Gen AI’s path to modernization.

Renuka Kambli is an AVP within Cognizant Business Consulting’s Banking and Financial Services practice. She heads the Lending and Payments Consulting practice for North America. She has 18+ years experience and was recognized by Consulting Magazine 2022 as a Women Leader in Technology.

Follow

Intuitive, real-time visualizations let manufacturing and warehouse managers model changes without downtime.

Our recent research demonstrates a surprising shift: It’s creative teams, not just technical teams, that are driving transformation through tools like generative AI.

Today’s horse-race coverage of artificial general intelligence fails to consider its implications.

As agentic AI systems continue to evolve, they will become an indispensable part of the modern financial infrastructure.

In-store retail is enjoying a renaissance—and with it, familiar challenges. Judicious use of AI in retail can help businesses thrive in this new era.

Sign up for the Cognizant newsletter to gain actionable AI advice and real-world business insights delivered to your inbox every month.