Moving to regenerative agriculture with data and technology

<p><br> <span class="small">February 09, 2024</span></p>

Moving to regenerative agriculture with data and technology

<p><b>Food and agriculture businesses have been slow to adopt the technologies needed for regenerative agriculture methods, according to our recent study. Here’s how they can overcome key challenges.</b></p>

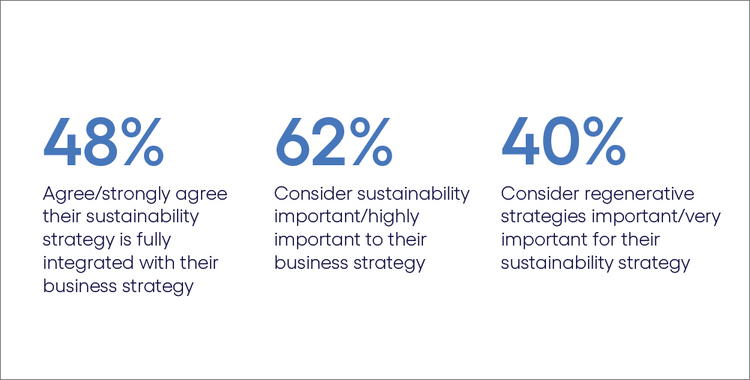

<p>The food and agriculture (F&A) industry is both highly vulnerable to environmental risks and a major contributor to them. However, the actions taken to address the industry’s greenhouse gas emissions and adapt to increasingly frequent severe weather events have fallen well short of reflecting the urgency of the situation.</p> <p>The impact of this inaction goes well beyond the industry. It’s not only producers and growers, commodity trading companies, food processors and manufacturers that pay the price: it’s the global economy itself. According to the UN Food & Agriculture Organization (FAO), the <a href="https://www.fao.org/3/cc7724en/cc7724en.pdf" target="_blank">environmental “hidden costs</a>” of the world’s agri-food systems totaled some $2.87 trillion in 2020 purchasing power parity.</p> <p>The risks inherent to the industry’s intensive agricultural practices cannot be overstated. <a href="https://www.unccd.int/sites/default/files/2022-04/UNCCD\_GLO2\_low-res\_2.pdf" target="_blank">Research indicates</a> that between 20% and 40% of the global land area is already degraded or degrading to some extent. If this trajectory continues, we will not only be consuming less nutritional food but will also end up with even <a href="https://www.weforum.org/agenda/2022/10/what-is-regenerative-agriculture/" target="_blank">less arable</a> land to feed the global population.</p> <p>Aware of this situation, 159 countries late last year signed the <a href="https://www.cop28.com/en/food-and-agriculture" target="_blank">Emirates Declaration on Sustainable Agriculture, Resilient Food Systems and Climate Action</a>. However, meaningful action depends on the hands-on involvement of F&A businesses.</p> <h4>Room for growth in agricultural sustainability</h4> <p>To gauge their attitude on this crucial topic, we surveyed 3,000 senior executives, including 295 from the food and agriculture industry, in partnership with Oxford Economics. Our findings revealed that, while executives widely acknowledge the need to focus on sustainability, the industry’s initiatives remain limited in scope. (For the full study, see “<a href="https://www.cognizant.com/us/en/insights/insights-blog/sustainability-in-business-beyond-green-to-deeply-green-wf1518050" target="_blank">Deep Green: how data, technology and collaboration will drive the next phase of sustainability in business</a>.”)</p> <p>For instance, less than half (48%) agree or strongly agree their sustainability strategy is fully integrated into their corporate business strategy. Moreover, only 62% consider environmental sustainability an important or highly important part of their overall business strategy—a shockingly low share given the existential threat this area poses to the industry.</p> <p>The truth is, since intensive monoculture releases CO2 stored in the soil and undermines biodiversity and crop resilience, as long as F&A companies follow this practice, they are increasingly vulnerable to extreme weather.</p> <p>Fortunately, there is a viable alternative: regenerative agriculture. This is an approach based on techniques such as crop rotation and agroforestry, among others, to improve soil and ecosystem health. It makes soils richer, helps them retain carbon and boosts biodiversity and growers’ incomes—all while increasing resilience to extreme weather. Modern technologies can turbocharge regenerative practices by providing precise, real-time data across multiple parameters.</p> <p>It sounds like a no-brainer, but in our study, only four in 10 F&A companies consider regenerative strategies important or very important for their sustainability strategies.</p> <h4>A sustainability disconnect</h4> <p><i>Our study revealed low levels of engagement in sustainability efforts, especially when it comes to pursuing regenerative strategies</i><b>.</b></p>

#

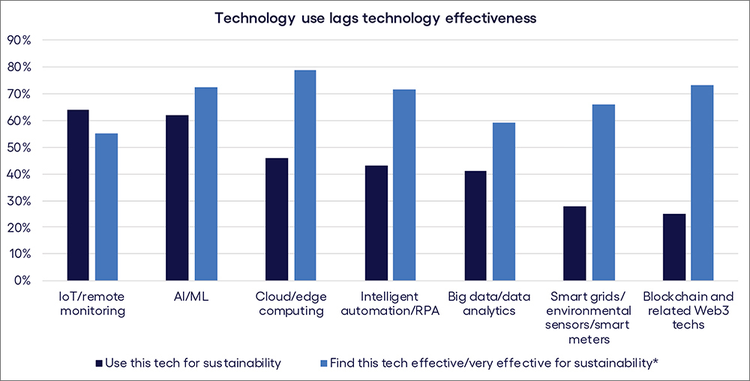

<p><span class="small">Base: 250 senior leaders in food and agriculture<br> Source: Cognizant and Oxford Economics<br> Figure 1</span></p> <p>Inertia and overwhelm in the face of a big, highly complex problem partly explains the inaction. But we’ve identified three actions F&A businesses could take to move forward with a regenerative approach and achieve a more sustainable way of producing food: invest in data collection and governance, make the most of precision agriculture technologies and build partnerships focused on the longer term.</p> <h5><span style="font-weight: normal;">#1 Invest in data collection and governance capabilities in agriculture</span></h5> <p>In agriculture, as in many other industries, high-quality data is key to making good choices. Data-driven insights on everything from short- and long-term weather forecasts to soil acidity can help growers boost the regenerative potential of their activities and make their fields more resilient to extreme climate events.</p> <p>Technologies such as remote sensing (satellites and drones), water quality sensors and crop monitors are crucial. Artificial intelligence (AI) and advanced data analytics translate data into actionable insight. Strong data governance, meanwhile, is key to maximizing data quality and security.</p> <p>As different F&A players invest in data collection, sharing and governance, their efforts will benefit their partners, creating a symbiotic relationship that increases the resilience of the industry as a whole. Today, however, only 42% of F&A respondents in our study have deployed analytics tools to generate insights to boost their sustainability performance.</p> <p>By addressing two specific challenges, F&A companies could make giant strides in their data collection and governance efforts:</p> <ul> <li><b>Problem: Siloed data. </b>Many F&A firms still store their data in silos instead of in an integrated platform accessible by different areas of the business. Climate-related data is often held by departments responsible for ESG initiatives, which lack immediate access to data on issues such as yields and financial outcomes.<br> <br> Moreover, less than half (48%) of respondents in our study believe their companies have significantly adapted their organizational structures and roles to improve sustainability. As a result, they lack a holistic view of risks and opportunities and, therefore, the foresight necessary to manage climate-related risks in a timely way. Unsurprisingly, only 53% of F&A companies can report timely, reliable data on the performance of sustainability initiatives.<br> <br> </li> <li><b>Solution: Unify data for cross-company access. </b>An example of what is possible when data is unified is <a href="https://www.bayer.com/media/en-us/bayer-demonstrates-digital-technologies-as-a-key-enabler-for-regenerative-agriculture/" target="_blank" rel="noopener noreferrer">Bayer’s FieldView</a>, a digital farming platform aimed at giving farmers access to a wide range of data to support regenerative efforts. The platform pulls in data from satellites, sensors, farm equipment and other sources, and makes it available via AI-driven visualization and analysis. Farmers get insights like which biodiversity actions are best suited for their particular farm.<br> <br> </li> <li><b>Problem: Weak data ecosystems. </b>Sophisticated modeling requires large amounts of data. Companies that help create and engage in data-sharing ecosystems can accumulate more data faster, benefiting the whole value chain. For example, analytics applied to farm data—such as the sowed area of different crops, soil composition and weather forecasts—enables more accurate predictions of production volumes, quality assessments and pre-harvest information for potential buyers.<br> <br> </li> <li><b>Solution: Join data-sharing platforms focused on regenerative agriculture. </b>To understand the benefits of such improved data flows, consider how the <a href="https://sourceup.org/" target="_blank" rel="noopener noreferrer">SourceUp</a> platform connects producers, local governments, civil society organizations and traders operating in specific regions, making sustainability-related data available to all to support superior decision-making.<br> <br> Or take the case of <a href="https://regenconnect.cargill.com/" target="_blank" rel="noopener noreferrer">Cargill’s RegenConnect program</a>, which was launched in 2020 and now covers over one million acres across the Americas, Europe and Oceania. The food and agriculture giant partnered with carbon measurement firm Regrow, which makes its Measure, Report and Verify (MRV) platform available for farmers. The platform uses in-field data, remote sensing and crop and soil health modeling, offering growers a simple and transparent way to measure their environmental impact. RegenConnect also allows farmers to use the data generated to participate in carbon markets, further boosting their incomes.<br> </li> </ul> <h5><span style="font-weight: normal;">#2 Make the most of precision agriculture techniques</span></h5> <p>Precision agriculture is a necessary and natural complement to regenerative agriculture. It also supports data management, which in turn makes it even more effective.</p> <p>By using technologies such as on-ground sensors, geopositioning systems (GPS), geographic information systems (GIS) and remote sensing, farmers can generate real-time data that allows them to manage their crops more efficiently, reduce the use of water and fertilizers, improve soil nutrients and reduce greenhouse gas emissions. For instance, GPS, GIS and remote sensing can enable farmers to tailor their water use to the needs of different parts of their farms.</p> <p>Technologies such as IoT and remote sensing collect data on soil composition, the weather and biodiversity. Using this data as inputs, cloud-based AI solutions can then generate location-specific recommendations. This reduces costs, boosts productivity and enables farmers to take preemptive actions to avoid pests and disease with minimized use of pesticides.</p> <p>Unsurprisingly, a growing number of farmers have been moving toward precision agriculture technologies. As of 2019, according to the US Department of Agriculture (USDA), <a href="https://www.dtnpf.com/agriculture/web/ag/news/business-inputs/article/2023/03/28/usdas-big-precision-tech-study-shows" target="_blank" rel="noopener noreferrer">64.5% of cotton farmers</a> in the country were using auto-steer guidance systems, and 40% of all US farms deployed GPS systems.</p> <p>However, as our survey indicates, the industry is still far from making the most of the sustainability opportunities provided by precision agriculture.</p> <p>While an impressive 64% of F&A executives in our study said they’ve adopted IoT, only 46% and 41% have implemented cloud/edge and big data analytics, respectively, to improve their sustainability efforts. At the same time, the majority of those who have adopted these technologies found them to be effective or very effective (see Figure 2).</p>

#

<p><span class="small">Base: 250 senior executives from food and agriculture companies<br> *Reflects the share of respondents whose companies have used this technology to improve their environmental performance<br> Source: Cognizant and Oxford Economics<br> Figure 2</span></p> <p>In a recent <a href="https://www.mdpi.com/2073-4395/13/7/1818" target="_blank" rel="noopener noreferrer">study</a> of two durum wheat farms in central Italy, research revealed that the farm that adopted precision agriculture technologies was substantially less affected by the 2022 surge in input prices than the one that did not. Separately, <a href="https://www.farmersguide.co.uk/arable/robot-cuts-chemical-use-by-up-to-95-per-cent/" target="_blank" rel="noopener noreferrer">a study by the University of Reading</a> found that another precision agriculture technique—robotic chemical spraying—reduced chemical use by 95%.</p> <h5><span style="font-weight: normal;">#3 Build partnerships focused on the longer term</span></h5> <p>Many F&A companies fear that, even if the longer-term environmental and financial benefits of regenerative agriculture are worth the effort, in the short-term they may see a costly fall in production.</p> <p>This dilemma between immediate and long-term rewards is reflected in our survey. Even as 55% of F&A companies expect their sustainability initiatives to improve their business performance in the mid- to longer-term, half believe it is difficult to convert long-term sustainability targets into short-term actions.</p> <p>Real-world evidence suggests the medium- and long-term gains far outweigh possible initial loss in yields and set in motion a virtuous cycle of growth. A <a href="https://www.agribusinessglobal.com/sustainability/new-research-reveals-organic-agriculture-produces-higher-crop-yields-during-periods-of-extreme-weather/" target="_blank" rel="noopener noreferrer">40-year side-by-side field study</a> by the Rodale Institute found that regenerative organic farm yields were similar to those of conventional farms in the absence of extreme climate events, such as droughts and floods, but substantially higher during those situations.</p> <p>However, no grower can adopt a regenerative model alone. Farmers need to rely not only on a clear vision and good planning, but also on an ecosystem of partners, from finance providers to suppliers and traders, willing to support it. Such partnerships would help food producers in the following ways:</p> <ul> <li><b>Policy support. </b>As with the energy transition, policy support—though not sufficient on its own—has a fundamental role to play. Some governments have taken the lead. The European Commission <a href="https://commission.europa.eu/strategy-and-policy/priorities-2019-2024/european-green-deal/sustainable-use-key-natural-resources\_en" target="_blank" rel="noopener noreferrer">has proposed</a> <a href="https://ec.europa.eu/commission/presscorner/detail/en/qanda\_23\_3637" target="_blank" rel="noopener noreferrer">soil monitoring legislation</a> to provide a clear definition of soil health and put in place a coherence monitoring framework. With 60% of soils in the bloc considered unhealthy and the estimated cost of soil degradation reaching €50bn per year, soil data will help farmers improve their understanding of trends on droughts, water retention and erosion. This will help them adopt precision agriculture technique to support a regenerative approach and create further innovation opportunities.<br> <br> </li> <li><b>Financial support. </b>Finance for the transition needs to be available at rates accessible to farmers of all sizes. This makes commercial sense to banks. <a href="https://www.natwestgroup.com/news-and-insights/latest-stories/climate/2022/nov/financing-nature-positive-transition-in-the-agriculture-sector.html" target="_blank" rel="noopener noreferrer">As Maria Carvalho</a>, Head of Climate Economics and Data at UK-based financial group NatWest <a href="https://www.natwestgroup.com/news-and-insights/latest-stories/climate/2022/jun/financing-nature-positive-transition-in-the-agriculture-sector.html" target="_blank" rel="noopener noreferrer">puts it,</a> “by recognizing that emission reduction efforts by farmers will make their businesses more attractive to their retail customers, as well as helping to reduce risk, banks can subsequently reflect this in the cost of lending.”<br> <br> Some initiatives have shown how this can work. In 2022, the Environmental Defense Fund (EDF) and agtech company Farmers Business Network (FBN) <a href="https://www.edf.org/media/majority-farmers-who-participated-groundbreaking-farm-loan-achieved-environmental-standards" target="_blank" rel="noopener noreferrer">partnered to launch</a> a $25 million pilot fund, including a 0.5% interest rate rebate, for US farmers to encourage regenerative practices and reward those that achieved climate and water quality benchmarks. The project used FBN’s data platform to monitor and validate regenerative practices across 42,000 acres of farmland. <a href="https://business.edf.org/insights/breakthrough-agricultural-loan-rewards-farmers-for-agricultural-stewardship/" target="_blank" rel="noopener noreferrer">Eighty-three percent</a> of the farmers that completed the program’s requirements met the standards for fertilizer efficiency and soil health practices.<br> <br> </li> <li><b>Value chain support. </b>Food packagers, manufacturers and trading companies also need to play a role in this transformation. By supporting it, these companies can tackle their Scope 3 emissions and underpin more stable availability of their businesses’ input.<br> <br> PepsiCo, for example, worked with UK universities to develop an IoT technology called <a href="https://www.ft.com/partnercontent/pepsico/why-regenerative-agriculture-could-be-key-to-our-sustainable-future.html" target="_blank" rel="noopener noreferrer">iCrop</a> to generate real-time data on different aspects of crop production and performance. This created opportunities for its suppliers to understand where and how they can improve soil quality and reduce water usage. The technology has helped Spanish farmers increase the accuracy of irrigation from 48% to 93% in just two years.</li> </ul> <h4>Regenerative agriculture: a resilient and secure food supply chain</h4> <p>The transition to a resilient, sustainable food supply chain benefits everyone, from financiers and farmers to retailers and consumers. Technology can, and should, be put to the service of regenerative agriculture to make this essential transition a reality.</p> <p>F&A companies willing to look beyond possible initial turbulence will secure their own future, while leading the way for the rest of the food ecosystem.</p> <p><i>Learn how your business (or you) can become sustainable to the core in our report, “</i><a href="https://www.cognizant.com/us/en/insights/insights-blog/sustainability-in-business-beyond-green-to-deeply-green-wf1518050" target="_blank" rel="noopener noreferrer">Deep Green: How data, technology and collaboration will drive the next phase of sustainability in business</a><i>.”<br> </i></p>