<p><br> <span class="small">December 02, 2024</span></p>

Capitalizing on the Benelux gen AI advantage

<p><b>Our recent study shows high interest and investment in generative AI among businesses in Benelux but low confidence in their ability to roll out gen AI strategies. By overcoming hurdles such as talent shortages and taking advantage of accelerators like data readiness, businesses can realize greater AI momentum.</b></p>

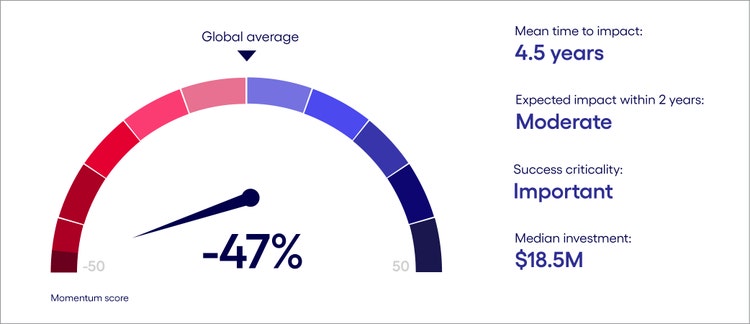

<p>Businesses in Belgium, The Netherlands and Luxembourg (Benelux) believe generative AI is critical to their future success, according to our recent research, and it shows in their planned expenditures. Benelux businesses plan to spend a median of $18.5 million on this powerful technology this year, well above the global median of $12.5 million.</p> <p>At the same time, our study indicates a relatively low level of confidence regarding the ability to successfully roll out their generative AI strategies. A clear majority of these businesses (73%) believe they aren't moving fast enough with their generative AI strategies, and almost six in 10 (59%) believe this will open the door for competitors to get ahead.</p> <p>The fact is, regional variances—regulatory environment, country infrastructure and available talent, for instance—as well as internal factors like the business’s own technology foundation, will influence success with implementing generative AI strategies and how businesses use this powerful technology. As a result, the pace of generative AI uptake and the way in which it’s used will be uneven across the globe.</p> <p>To better understand what generative AI adoption will look like globally, we conducted a study of 2,200 business leaders in 23 countries and 15 industries, including 90 in Benelux. The study assessed a wide range of generative AI adoption trends, including investment levels, use cases, how critical gen AI strategies are to business success and organizational readiness to adopt the technology.</p> <p>We also analyzed 18 regional and internal business factors that will either inhibit or accelerate business adoption of gen AI (see the end of the report for the full list of factors). Respondents evaluated each factor’s potential impact on their generative AI strategy, rating it as either positive or negative on a scale of high to low impact.</p> <p>From the results, we calculated a “momentum score” for each country or region. The momentum score represents the level of confidence business leaders have about their ability to roll out their generative AI strategy based on internal business factors and the prevailing local conditions of their country or region.</p> <p>For all the regions covered, inhibitors to adoption outranked accelerators, meaning that all momentum scores skewed negative. In effect, businesses globally feel constrained by their operating environment.</p> <p>But to understand how different regions varied relative to each other, we averaged the ratings to establish a baseline global momentum score. This approach enabled us to identify regions that are more optimistic about their ability to adopt the technology compared with a global average.</p> <p>For Benelux, the momentum score is 47% lower than the global average. The factors contributing to this score vary from country to country, but the most impactful for Benelux are a relatively pessimistic view of the cost and availability of talent and consumer perceptions compared with other countries. An additional factor pulling the score back for Benelux leaders is an acute concern about the maturity of gen AI-related technologies. At the same time, Benelux respondents voiced relatively high optimism regarding their data readiness.</p>

<p><span class="small"><b>Benelux gen AI scorecard</b></span></p>

#

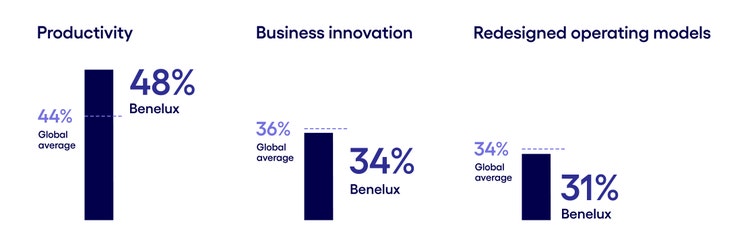

<p><span class="small">Base: 90 senior business leaders in Benelux<br> Source: Cognizant and Oxford Economics <br> Figure 1 </span></p> <p>As for where their generative AI investments will be aimed in the near term, we looked at two distinct uses of the technology: productivity, such as helping people work more quickly and get more done, and disrupt-the-business innovations, which involve more sweeping change to business and operating models. Overall, Benelux mirrors the global trend: Over the next two years, more respondents emphasized productivity as their greatest strategic priority (see Figure 2).</p> <p><b>Greater focus on productivity than innovation</b></p> <p><i>Q: Which of the following best describes the role generative AI will play in your organization's business strategy in the next two years? (Percent of respondents naming each as a top-three choice)</i></p>

#

<p><span class="small">Base: 90 senior business leaders in Benelux<br> Source: Cognizant and Oxford Economics<br> Figure 2</span></p> <p>However, our study also reveals a change in what productivity means when pursued with generative AI. The end goal is not efficiency and cost-cutting as has been the case with previous automation endeavors. This new dynamic requires fresh thinking around understanding business use cases of generative AI, which we’ll address later in this report.</p> <p>This report identifies the regional and business factors that could either inhibit or accelerate generative AI momentum in the Benelux region. It also provides an industry-specific look at how generative AI will be used, a regional focus on business readiness and strategies to successfully implement generative AI in Benelux.</p>

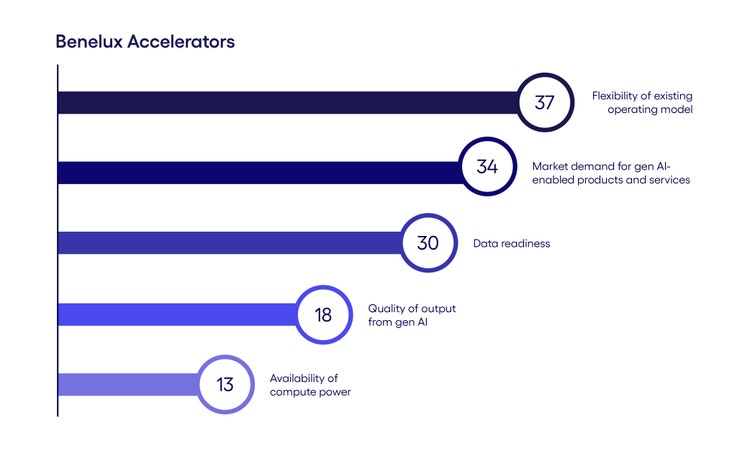

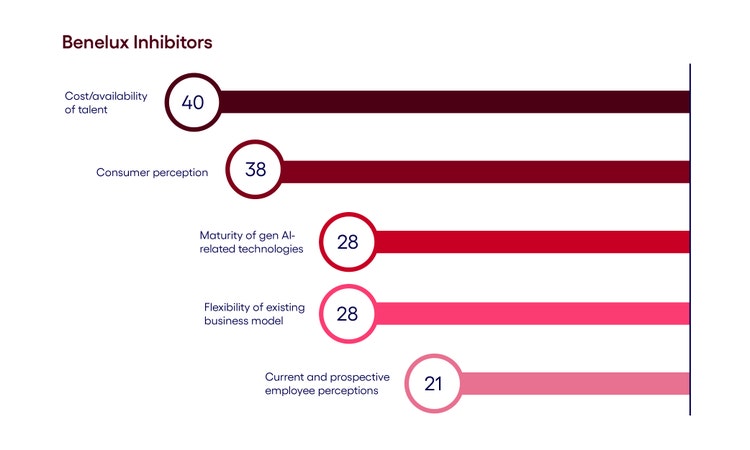

<h4>Inhibitors and accelerators: The forces shaping AI momentum</h4> <p>To dig deeper into these mechanics, rather than comparing to a global average, we’ll now examine how business leaders rate inhibitors and accelerators within their region. By doing so, our study provides a detailed temperature check that leaders can use to take advantage of what’s working well in their local environment, while strategizing on how to overcome challenges.</p> <h5>A look at Benelux gen AI accelerators</h5>

#

<p><span class="small">Respondents were asked which factors inhibit or accelerate their organization's adoption of generative AI. Score represents a percentage point difference to the country's momentum score compared to the global baseline.</span></p> <p><span class="small">Base: 90 senior business leaders in Benelux<br> Source: Cognizant and Oxford Economics<br> Figure 3</span></p> <p>A key driver for AI adoption in the Benelux region is<b> </b>a high level of perceived <b>data readiness</b>. In this region, senior leaders feel their data is ready to be taken to the next level with gen AI capabilities.</p> <p>However, digging deeper into our survey results, we can see the nuances in companies’ data capabilities. While leaders are more likely to rate the quality and cleanliness of their data as either good or excellent (62% of respondents sit in this category), 50% of respondents believe their data accessibility needs improvement. The risk is that any momentum gained through high data readiness may be stalled by accessibility challenges.</p> <p>In addition, they have an optimistic view about the <b>flexibility of their operating model</b>. Technology and data leaders across The Netherlands and Belgium anticipate the transition to generative AI will be more of an <a href="https://www.cognizant.com/nl/en/insights/blog/articles/the-game-of-value-in-the-ai-enabled-organization" target="_blank" rel="noopener noreferrer">organic evolution rather than an alteration of the status quo</a>. This suggests that many companies believe they have what they need to transition existing operations to a generative AI-enabled approach.</p> <p>Benelux businesses are also optimistic about the quality of output of the technology. This confidence in the quality of generative AI output plays out in the business cases respondents highlighted in our survey. For example, seven in 10 already use it to write or test software code, underscoring the idea that companies trust this technology to play a role in at least some aspects of technical, complex workflows. The trust in the quality of output among executives is juxtaposed alongside low consumer perceptions that we will address in in the next section.</p> <p><b>Market demand </b>is another adoption accelerator for Benelux businesses. Nearly 60% of senior business leaders are either highly or critically worried that current competitors will get ahead if their own business delays or limits implementing generative AI across their organization. This suggests that companies must act quickly to secure an advantage.</p> <h5>Understanding Benelux’s gen AI inhibitors</h5>

#

<p><span class="small">Respondents were asked which factors inhibit or accelerate their organization's adoption of generative AI. Score represents a percentage point difference to the country's momentum score compared to the global baseline.</span></p> <p><span class="small">Base: 90 senior business leaders in Benelux<br> Source: Cognizant and Oxford Economics<br> Figure 4</span></p> <p>Among the top factors inhibiting adoption is the <b>cost and availability of talent</b>. Local AI talent continues to be challenging, with AI talent pools more available in some regions than others. The shortages vary by region, according to a recent <a href="https://thescalers.com/tech-talent-shortage-benelux/#:\~:text=The%20growing%20skills%20gap%20in%20Belgium\&text=It%20ranks%20in%20the%20top,according%20to%20Manpower%27s%202023%20survey." target="_blank" rel="noopener noreferrer">report</a> by the multinational staffing organization Manpower. In the Brussels Capital Region, for instance,<b> </b>CTOs, heads of ICT departments, software engineers and system analysts are specifically in short supply, whereas in the Flemish Region, the gap is in integration and implementation experts, ICT business analysts, engineering team managers and database administrators. Meanwhile, in the Walloon Region, shortages are most acute for operation managers, software developers, web developers and ICT analysts.</p> <p>The talent shortages are attributed to shifts in the population’s demographic characteristics, the increasing digitization of legacy industries and the growing demand for IT professionals due to advancements in machine learning and gen AI. This is exemplified by Luxembourg, <a href="https://www.stiftung-nv.de/publications/where-is-europes-ai-workforce-coming-from" target="_blank" rel="noopener noreferrer">where 95% of the AI workforce holds international degrees</a>, highlighting the escalating demand for IT professionals that exceeds the current capabilities in certain areas.</p> <p>Human-centric AI development is a common theme across each country’s AI strategy in Benelux. For example, in The Netherlands, the aim is to <a href="https://ai-watch.ec.europa.eu/countries/netherlands/netherlands-ai-strategy-report\_en#human-capital" target="_blank" rel="noopener noreferrer">reinforce human skills in AI at all education levels</a>, while Belgium plans to utilize a <a href="https://knowledge4policy.ec.europa.eu/sites/default/files/belgium-ai-strategy-report.pdf" target="_blank" rel="noopener noreferrer">national online course</a> on AI to build skills. Luxembourg, meanwhile, <a href="https://ai-watch.ec.europa.eu/countries/luxembourg/luxembourg-ai-strategy-report\_en" target="_blank" rel="noopener noreferrer">plans to focus government actions</a> on enhancing AI skills and competencies and providing opportunities for lifelong learning.</p> <p>While these publicly available plans suggest that each country is taking steps to accelerate AI readiness, most do not appear to have been updated since late 2022 when ChatGPT and other gen AI tools were launched. This suggests that countries need to refresh their strategy to account for the newest gen AI tech to remain competitive in the global AI race.</p> <p>In the private sector, according to our study, over half (52%) of Benelux respondents plan to implement training programs to upskill employees. Four in 10 (40%), however, are looking to hire specialized generative AI talent—difficult to do amid talent scarcity. </p> <p>A second inhibitor to generative AI adoption is <b>consumer perceptions</b> in the region. This issue may stem from high-profile events like the child benefits scandal in The Netherlands, wherein the country’s tax authorities utilized a self-learning algorithm to create risk profiles to combat identify fraud. Because of the system’s inaccurate risk indicators, tens of thousands of families endured unnecessary hardships, and more than a thousand children were taken into foster care. Since that time, a Dutch non-profit organization that promotes consumer protections has <a href="https://www.beuc.eu/press-releases/consumer-groups-call-regulators-investigate-generative-ai-risks-enforce-existing" target="_blank" rel="noopener noreferrer">banded together</a> with 13 other European countries in calling on regulators to investigate generative AI risks and enforce existing legislation.</p> <p>Belgium appears to be taking steps to address this issue of consumer perception. In February 2024, the country launched a <a href="https://belgian-presidency.consilium.europa.eu/en/news/launch-of-citizens-panel-on-artificial-intelligence/#:\~:text=A%20citizens%27%20panel%20to%20shape,education%20and%20other%20demographic%20criteria." target="_blank" rel="noopener noreferrer">citizens' panel to shape the future of AI in Europe</a>. The panel, which consists of 60 people selected at random, will help ensure citizens’ voices are reflected in AI policies and decision-making.</p> <p>A third inhibitor of generative AI is the <b>maturity of gen-AI related tech. </b>This becomes clear when we take a closer look at how Benelux businesses are currently using the technology today. Many appear cautious about fully integrating the tech into their operations; while 79% of businesses have deployed generative AI to add a new revenue source to the mix, only 42% have used the technology to design or deliver new or enhanced products, services or experiences that would directly face their customers. In addition, only 37% use the technology to suggest text or write first drafts of their work.</p>

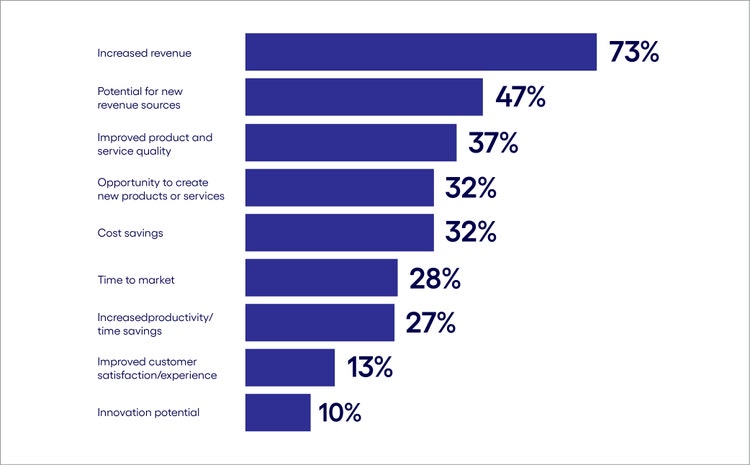

<h4>Sector spotlight: Stark differences in industries’ gen AI priorities</h4> <p>Of course, there are many use cases and strategies for using generative AI. As we’ve said, Benelux businesses are primarily focused on realizing productivity gains with generative AI, at least in the next two years. However, a look at what’s driving their business cases sheds a new light on productivity from how it’s been seen historically.</p> <p>Traditionally, businesses have equated automation productivity gains with cost-cutting; driving down the cost of output by reducing the number of people needed to get work done.</p> <p>While generative AI-driven automation will likely lower headcount to some degree, that is no longer the end goal. Instead, as seen through the metrics respondents will use to drive business cases, we see a shift toward redirecting productivity gains into funding endeavors that increase revenues or lead to entirely new revenue streams.</p> <p>The metrics Benelux respondents say will be most important for justifying generative AI expenditures include increased revenue (73%), potential for new revenue sources (47%) and improved product and service quality (37%). Conversely, metrics like cost savings, increased productivity and time savings were cited by 32% of respondents or fewer. In other words, productivity no longer stops at cost-cutting—businesses appear to be redirecting productivity gains into initiatives aimed at growth.</p> <h5>Increased revenue is a top metric for justifying gen AI use cases</h5> <p><i>Q: Which of the following metrics are most important in terms of justifying your organization’s generative AI business cases? (Percent of respondents naming each as a top-three choice)</i></p>

#

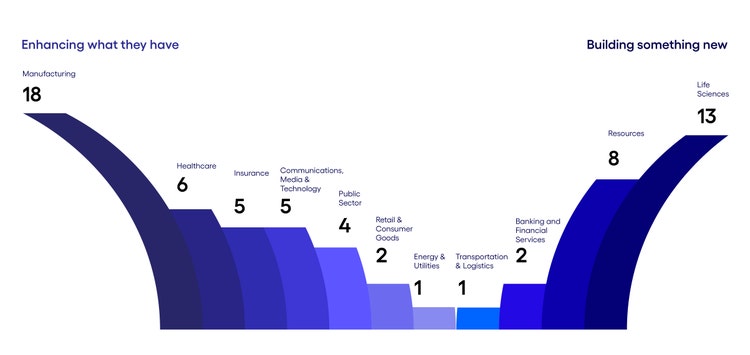

<p><span class="small">Base: 90 senior business leaders in Benelux<br> Source: Cognizant and Oxford Economics<br> Figure 5</span></p> <p>Using this more granular view of productivity goals and business drivers, we analyzed the differences in how industries intend to use the technology.</p> <p>Rather than focusing on the distinction between productivity vs. innovation, we grouped the metrics into two high-level categories of business use cases: </p> <ul> <li><b>Enhancing current business performance </b>(revenue, cost savings, time-to-market, productivity)</li> <li><b>Building something new</b> (new revenue sources, new or improved products, innovation)</li> </ul> <p>We then assigned each of the metrics a score to see the relative gap between a number-one-ranking metric and a number-three-ranking metric. By calculating the average score across industries, we could clearly see how each industry’s responses deviated from the baseline.</p> <p>Our analysis reveals stark differences among Benelux industries in terms of the business use cases they’ll likely prioritize (see Figure 6). </p> <h5>Industries diverge on business cases</h5>

#

<p><span class="small">Note: This figure depicts each industry’s relative deviation from a baseline of “zero,” using a ranked scoring of the top three metrics respondents cite as important for justifying their generative AI use cases. It reveals a weighted view of each industry’s overall priorities for gen AI deployment.</span></p> <p><span class="small">Base: 90 senior business leaders in Benelux<br> Source: Cognizant and Oxford Economics<br> Figure 6</span></p> <p><b>The manufacturing </b>sector in the region is focused on boosting current business performance. For instance, Belgian tech collaborative center Agoria helps firms innovate by offering a test factory where entrepreneurs can experiment with new production methods, driving them into the <a href="https://www.sirris.be/en/inspiration/sirris-turns-industry-40-practice-manufacturing-companies" target="_blank" rel="noopener noreferrer">fourth industrial revolution</a>. Experts suggest generative AI can assist operators by quickly generating work instructions from manuals, spoken directives and video analysis, as well as creating production chatbots that provide tailored company information to help resolve issues.</p> <p><b>The healthcare</b> sector is similarly intent on improving current operations. The Netherlands-based AI app and generative AI platform <a href="https://healthsage.ai/" target="_blank" rel="noopener noreferrer">HealthSage AI</a>, for example, offers a wide variety of AI models, tools and applications that healthcare organizations can use to streamline clinician workflows, encode clinician notes for billing processes and enrich datasets with unstructured data for better insights, analytics and research.</p> <p><b>The life sciences</b> sector, meanwhile, is focused on innovating traditional processes. Galapagos, a Belgian pharmaceutical company, has <a href="https://www.businesswire.com/news/home/20220628005106/en/Iktos-Announces-Collaboration-With-Galapagos-in-AI-For-Drug-Design" target="_blank" rel="noopener noreferrer">joined forces</a> with generative AI company Iktos to speed the identification of potential preclinical candidates and discover new chemical matters with favorable properties.</p> <p><b>The resources </b>sector is similarly focused on creating new capabilities with generative AI. For example, in Luxembourg, an AI-enabled HVAC platform called <a href="https://www.siliconluxembourg.lu/when-technology-helps-staff-breathe-easier-foobot-sensilla/" target="_blank" rel="noopener noreferrer">Foobot</a> leverages intelligent automation to simultaneously optimize energy use, air quality and comfort. The solution creates a virtual model of a building that is injected with Foobot’s AI algorithms to test millions of scenarios and provide recommendations for improvements.</p>

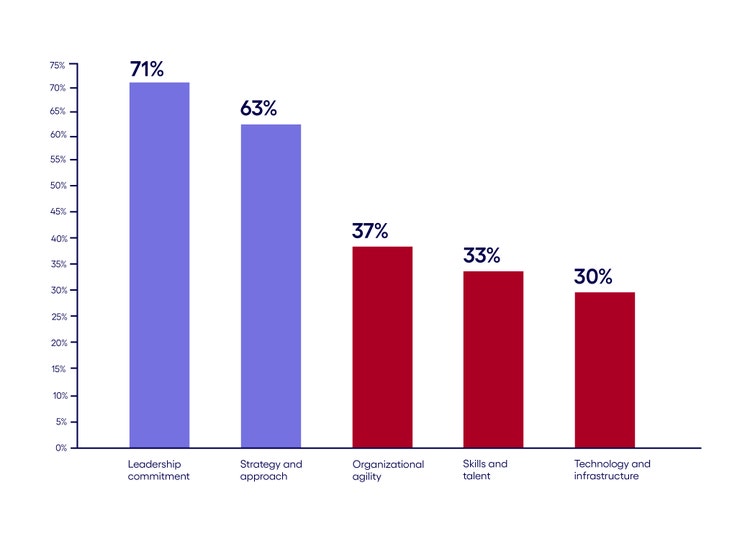

<h4>Business constraints: Talent shortages and shaky tech foundations</h4> <p>A remaining question is whether businesses are ready to drive real value from these business cases.</p> <p>The answer, according to our research, is mixed. To better understand how prepared executives believe their business is to adopt generative AI, we asked respondents to rank their organization’s maturity on a scale of 1 to 4 by selecting a statement that best described their organization in the following five areas, from low maturity to high:</p> <ul> <li>Organizational agility</li> <li>Leadership commitment</li> <li>Skills and talent</li> <li>Strategy and approach</li> <li>Technology and infrastructure</li> </ul> <p>The message from business leaders in the Benelux region is evident: Leadership commitment is high, and strategies are robust (perhaps a testament to the multimillion-dollar investments most respondents report). However, the fundamental operational and technological building blocks necessary to adopt the technology are lacking (see Figure 7).</p> <h5>Leadership support is sound, but fundamentals are lacking</h5> <p><i>Respondents were asked to rate the maturity of their organization's operations in relation to generative AI. (Percent of respondents rating each as a 3 or 4, with 4 representing the highest level of maturity)</i></p>

#

<p><span class="small">Base: 90 senior business leaders in Benelux<br> Source: Cognizant and Oxford Economics<br> Figure 7</span></p> <p>As discussed above, skills and talent are one of the largest inhibitors to AI adoption in the Benelux region. In addition, tech infrastructure is another area of concern, a point that could undermine the region’s high data readiness scores.</p> <p>Further, when it comes to the change enablers, while data quality is rated high (62% rate it as good or excellent), many other foundational aspects are lacking. These include the ability to comply with company rules, policies and frameworks, customer privacy and contracts, and the government. All of these compliance capabilities achieved the lowest three ranks by most respondents.</p>

<h4>Path to success: Strategic recommendations for Benelux businesses</h4> <p>The challenge ahead is to take full advantage of the factors that could encourage gen AI strategy success while overcoming challenges. </p> <p>To navigate this landscape, executives should prioritize the following actions:</p> <ul> <li><b>Begin setting compliance frameworks now:</b> Given the lower momentum for AI adoption across the regions, it is essential for businesses to establish an AI governance framework as the pace of adoption increases. Doing so will ensure businesses deploy AI in a responsible, safe, secure and compliant way.<br> <br> Our research reveals that many companies recognize the importance of developing such guardrails, with 36% of respondents reporting they are looking to partner with consultants on AI. In addition, enlisting the help of public or government entities specializing in oversight can ensure effective regulation plans, given the speed of change and the various hurdles to overcome. Working with a pragmatic partner who can help overcome roadblocks and assume risk will ensure that businesses become truly ready to face the future.<br> <br> </li> <li><b>Focus on building trust and transparency through education:</b> Improving public perception and understanding of AI technologies will help businesses streamline adoption. As stated above, the Benelux Union is focused on integrating AI learnings into all education levels, utilizing widespread national courses and providing lifelong learning in AI.<br> <br> Integrating fundamental AI education into the region's knowledge base can help build trust and understanding of the technology’s capabilities. This, in turn, can help push past personal inhibitions and help speed adoption in both work and consumer settings.<br> <br> </li> <li><b>Work together to achieve faster AI adoption:</b> The politico-economic alliance that Belgium, The Netherlands and Luxembourg share makes the Benelux region uniquely positioned for AI success. Collaborating strategically can help businesses achieve AI adoption goals and work through inhibitors more quickly than one country can alone.<br> <br> </li> <li><b>Invest in company-wide AI literacy and training:</b> While over 50% of Benelux businesses plan to implement upskilling programs for employees in specific roles, only 27% plan organization-wide training programs. Rolling out broader training programs upfront can help achieve generative AI familiarity and integration at a higher rate.<br> </li> </ul> <p><i>*The full list of regional factors we evaluated includes: the flexibility of the existing operating model, market demand for gen AI-enabled products and services, data readiness, quality of output from gen AI, availability of compute power, cost/availability of gen AI-related technologies, shareholder/investor sentiment, regulatory environment, sustainability, national infrastructure, cost/availability of capital, data privacy and security, existing technology infrastructure, current and prospective employee perceptions, flexibility of the existing business model, maturity of gen AI-related technologies, consumer perceptions and cost/availability of talent.</i></p> <p><i>Learn about the impact of generative AI on jobs and the economy in our report <a href="https://www.cognizant.com/us/en/gen-ai-economic-model-oxford-economics" target="_blank" rel="noopener noreferrer">New work, new world</a>.</i></p>

Table of Contents:

Introduction #spy-1

Inhibitors and accelerators: The forces shaping AI momentum #spy-2

Sector spotlight: Stark differences in industries’ gen AI priorities #spy-3

Business constraints: Talent shortages and shaky tech foundations #spy-4

Path to success: Strategic recommendations for Benelux businesses #spy-5

<h5>Authors</h5>

<p>With extensive AI and analytics experience, Gregory Verlinden drives growth through strategic insight, business acumen, and technical expertise. He excels at transforming data into innovative solutions, staying ahead of trends, and fostering strong client relationships.</p>

<p>Alexandria Quintana is a Senior Manager at Cognizant Research. With experience managing and deploying data-driven projects across diverse industries, she integrates research and marketing to curate insightful thought leadership pieces.</p>