<p><br> <span class="small">January 22, 2025</span></p>

Why France is positioned for success with generative AI

<p><b>While French businesses are trailing behind the global average in generative AI spending, according to our recent study, they are also much more optimistic about their ability to execute their gen AI strategies. Here's how French businesses can take advantage of regional accelerators and overcome inhibitors to unlock the potential of generative AI.</b></p>

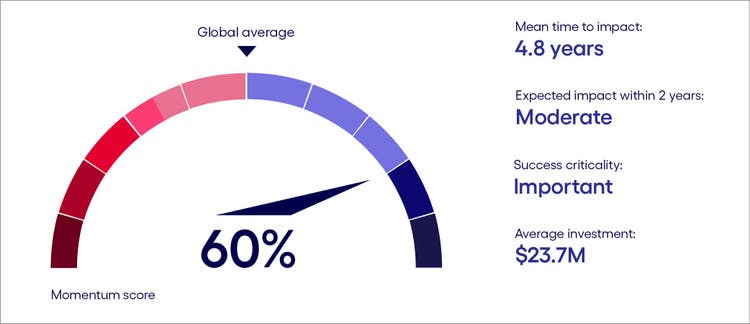

<p>Businesses in France view generative AI as critical to their future success, according to our recent study, but they appear to be struggling with the associated costs. While the government has <a href="https://multiplatform.ai/france-pledges-500-million-euros-in-funding-to-become-an-ai-powerhouse/#:\~:text=French%20President%20Macron%20announces%20500%20million%20euros%20in,world-class%20AI%20centers%2C%20and%20a%20powerful%20exascale%20supercomputer." target="_blank" rel="noopener noreferrer">committed to allocating €500 million </a>to AI training and development by 2030 to establish France as the AI hub of Europe, French businesses plan to spend just over $23.7 million on this powerful technology this year, which is under half the global average of $47 million.</p> <p>A clear majority (69%) believe they aren't moving fast enough with their generative AI strategies, and over half (52%) believe current competitors will get ahead.</p> <p>At the same time, the region offers an advantageous landscape for generative AI adoption relative to many other countries. The fact is, regional variances—regulatory environment, country infrastructure and available talent, for instance—as well as internal factors like the business’s own technology foundation, will influence success with implementing generative AI strategies and how businesses use this powerful technology. As a result, the pace of generative AI uptake and the way in which it’s used will be uneven across the globe.</p> <p>To better understand what generative AI adoption will look like globally, we conducted a study of 2,200 business leaders in 23 countries and 15 industries, including 100 in France. The study assessed a wide range of generative AI adoption trends, including investment levels, use cases, how critical gen AI strategies are to business success, and organizational readiness to adopt the technology.</p> <p>We also analyzed 18 regional and internal business factors that will either inhibit or accelerate business adoption of gen AI (see the end of the report for the full list of factors). Respondents evaluated each factor’s potential impact on their generative AI strategy, rating it as either positive or negative on a scale of high to low impact.</p> <p>From the results, we calculated a “momentum score” for each country or region. The momentum score represents the level of confidence business leaders have about being able to roll out their generative AI strategy, based on internal business factors and the prevailing local conditions of their country or region.</p> <p>For all the regions covered, inhibitors to adoption outranked accelerators, meaning that all momentum scores skewed negative. In effect, businesses globally feel constrained by their operating environment.</p> <p>But to understand how different regions varied relative to each other, we averaged the ratings to establish a baseline global momentum score. This approach enabled us to identify regions that are more optimistic about their ability to adopt the technology compared with a global average.</p> <p>For France, the momentum score is 60% higher than the global average. The factors contributing to this score vary, but the most impactful are respondents’ more optimistic views than their global peers when it comes to data privacy and security (which is viewed globally as an inhibitor but is cited as an accelerator by French respondents).</p> <p>Executives from the region also have a rosier view of the flexibility of their business model, the regulatory environment (again viewed globally as an inhibitor, but as an accelerator in France) and employee perceptions.</p> <p>That said, leaders in the region are more pessimistic than their global peers about the cost and availability of talent and the maturity of gen AI-related technologies. The region also has a more muted view of data readiness as an accelerator.<b></b></p> <p><b>France’s gen AI scorecard</b><br> </p>

#

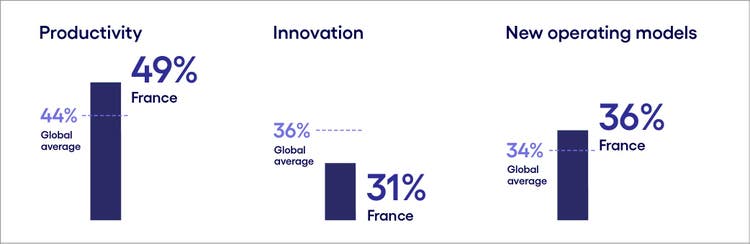

<p><span class="small">Base: 100 senior business leaders in France<br> Source: Cognizant and Oxford Economics<br> Figure 1</span></p> <p>As for where their generative AI investments will be aimed in the near term, we looked at two distinct uses of the technology: productivity, such as helping people work more quickly and get more done, and disrupt-the-business innovation, which involves more sweeping change to business and operating models. Overall, France mirrors the global trend: Respondents are emphasizing productivity as their greatest strategic priority (see Figure 2).</p> <p><b>Greater focus on productivity than innovation</b></p> <p><i>Q: Which of the following best describes the role generative AI will play in your organization's business strategy in the next two years? (Percent of respondents naming each as a top-3 choice)</i></p>

#

<p><span class="small">Base: 100 senior business leaders in France<br> Source: Cognizant and Oxford Economics<br> Figure 2</span></p> <p>However, our study also reveals a change in what productivity means when pursued with generative AI. The end goal is not efficiency and cost-cutting as has been the case with previous automation endeavors. This new dynamic requires fresh thinking around understanding business use cases of generative AI, which we’ll address later in this report.</p> <p>This report identifies the regional and business factors that could either inhibit or accelerate generative AI momentum in France. It also provides an industry-specific look at how generative AI will be used, a regional focus on business readiness, and strategies to successfully implement generative AI in France.</p>

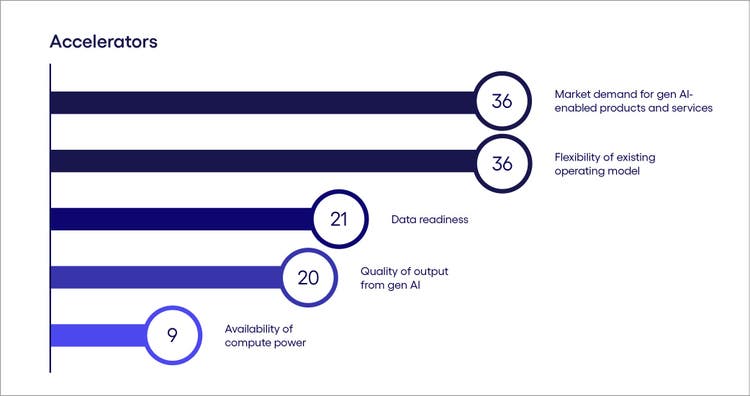

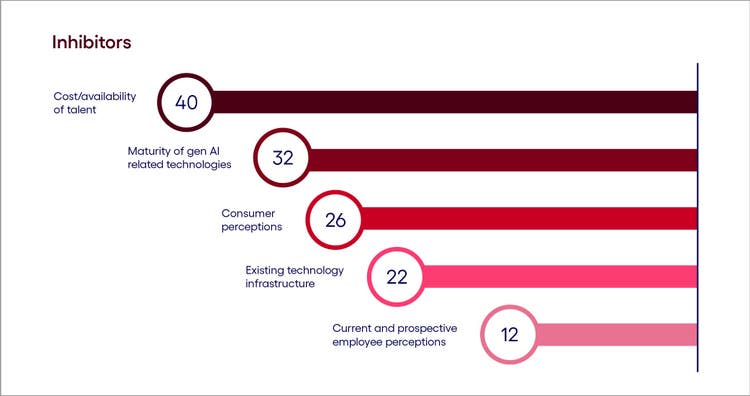

<h4>Inhibitors and accelerators: The forces driving AI momentum</h4> <p>To dig deeper into these mechanics, rather than comparing to a global average, we’ll now examine how business leaders rate inhibitors and accelerators within their region. By doing so, our study provides a detailed temperature check that leaders can use to take advantage of what’s working well in their local environment, while strategizing on overcoming challenges.</p> <p><b>A look at France’s gen AI accelerators</b><br> </p>

#

<p><span class="small">Respondents were asked which factors inhibit or accelerate their organization's adoption of generative AI. Score represents a percentage point difference to the country's momentum score compared to the global baseline.</span></p> <p><span class="small">Base: 100 senior business leaders in France<br> Source: Cognizant and Oxford Economics<br> Figure 3</span></p> <p>A key driver for adoption in the region is the<b> market demand for generative AI-enabled products and services</b>. In France, the use of generative AI surged by <a href="https://www.talan.com/our-news/detail/news/ifop-2024-barometer-for-talan-french-and-generative-ai/" target="_blank">60% between 2023 and 2024</a>, according to an Ifop study, and over one-third of users said they would struggle to complete tasks without the technology. Automated creation of spreadsheet formulas, meeting transcripts and documentation summaries, as well as schedule optimization, are just a few ways gen AI has helped workers. As the technology advances, the reliance on these work-enhancing tools will continue to grow, further strengthening the region’s demand for them.</p> <p>Leaders in the region also have an optimistic view about their <b>data readiness, </b>with 50% of respondents rating the quality and cleanliness of their data as either good or excellent. Data privacy and security is another area of confidence for respondents, with 40% of senior leaders in our study citing this as an accelerator for generative AI adoption. At the same time, 56% believe they need to improve their data accessibility. The risk is that any momentum gained through high data readiness will be stalled by challenges with legacy technology.</p> <p>The <b>perceived output quality of existing generative AI solutions</b> is an additional accelerator. France’s Mistral has rivaled OpenAI’s ChatGPT with its three large language models, Mistral Large, Mistral Small and Mistral Embedded, as well as a free chatbot, “Le Chat,” earlier this year. These products are reported to offer faster latency-to-performance ratios, have withstood biases and are easily tailored to meet business needs. The models’ ability to learn and respond in multiple languages opens the doors for broader accessibility for employees in France and around the globe.</p> <p>This confidence in the quality of generative AI output plays out in the wide range of business cases French respondents highlighted in our survey. Nearly 77% have deployed a generative AI solution for engaging directly with customers and consumers. And over three-quarters already use it to write or test software code.</p> <p>The <b>regulatory environment </b>in France is a distinctive accelerator, perceived as beneficial only to a select few countries. France was one of three countries, including Germany and Italy, that stonewalled negotiations over a section of the European Union’s draft AI legislation, pushing for a regulatory framework that would not impede on innovation. French President Emmanuel Macron and government officials fear that imposing strict regulations on new AI models will harm France’s efforts to establish itself as the AI hub of Europe and allow its competitors without such regulations to supersede them.</p> <p><b>Understanding France’s gen AI inhibitors</b></p>

#

<p><span class="small">Respondents were asked which factors inhibit or accelerate their organization's adoption of generative AI. Score represents a percentage point difference to the country's momentum score compared to the global baseline.</span></p> <p><span class="small">Base: 100 senior business leaders in France<br> Source: Cognizant and Oxford Economics<br> Figure 4</span></p> <p>Among the top factors inhibiting adoption, meanwhile, is the <b>cost and availability of talent</b>. AI talent continues to be challenging for the area; according to the <a href="https://ai-watch.ec.europa.eu/countries/france/france-ai-strategy-report\_en" target="_blank">French five-year national AI strategy</a> proposed by the French government, improving the AI education and training ecosystem to develop, retain and attract world-class talent has been a top priority for obtaining their goals of becoming Europe’s AI hub.</p> <p>To overcome the talent crunch, over half (53%) of French respondents plan to implement training programs to upskill employees. Roughly four in 10 (41%), however, are looking to hire specialized generative AI talent—difficult to do amid talent scarcity.</p> <p>To help combat the shortage, the French government has enacted talent visas to attract highly qualified personnel to the country. Since the enactment of the French Tech Visa in 2017, 1,150 companies have utilized it, contributing to the country’s AI development.</p> <p>A second inhibitor of generative AI is the <b>maturity of gen AI-related technologies.</b> While executives seem bullish about the capabilities of available solutions, they are looking for a wider and deeper array of generative AI solutions to unlock the next level of value and tackle more complex business challenges. </p> <p>A third inhibitor is <b>consumer perception</b>. <a href="https://business.yougov.com/content/46944-understanding-global-attitudes-towards-generative-ai" target="_blank">A recent survey</a> from research firm YouGov reveals France as the European country with the highest concern about gen AI technological changes, with half of French respondents airing their unease.</p> <p>An example of this kind of distrust is the backlash surrounding the biometric-driven mass surveillance for the 2024 Paris Olympics. In <a href="https://ecnl.org/news/civil-society-open-letter-proposed-french-law-2024-olympic-and-paralympic-games" target="_blank">a 2023 open letter</a>, 38 civil society organizations expressed their deep concerns for Article 7 of the 2024 Olympics law that would create a legal basis for using algorithm–driven cameras to detect specific suspicious events in public spaces. The authors of the letter believed this law violated international human rights and risks, going against the future EU AI Act.</p>

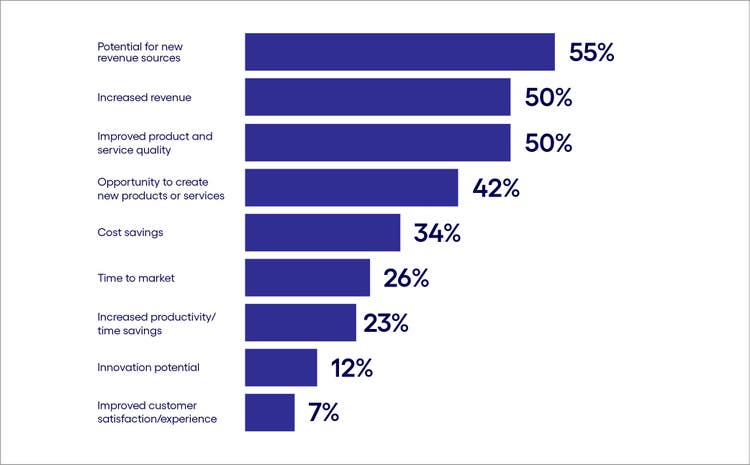

<h4>Sector spotlight: Stark differences in industries’ gen AI adoption priorities</h4> <p>Of course, there are many use cases and strategies for using generative AI. As we’ve said, businesses in France are primarily focused on realizing productivity gains with generative AI, at least in the next two years. However, a look at what’s driving their business cases sheds a new light on productivity from how it’s been seen historically.</p> <p>Traditionally, businesses have equated automation productivity gains with cost-cutting: driving down the cost of output by reducing the number of people needed to get work done.</p> <p>While generative AI-driven automation will likely lower headcount to some degree, that is no longer the end goal. Instead, as seen through the metrics respondents will use to drive business cases, we see a shift toward redirecting productivity gains into funding endeavors that increase revenues or lead to entirely new revenue streams.</p> <p>The metrics French respondents say will be most important for justifying generative AI expenditures include increased revenue, potential for new revenue sources and improved product and service quality, all of which were named by at least 50% of respondents. Conversely, metrics like cost savings, time-to-market and productivity were cited by 34% of respondents or fewer. In other words, the concept of productivity no longer stops at cost-cutting—businesses appear to be redirecting productivity gains into initiatives aimed at growth.</p> <p><b>Increased revenue is a top metric for justifying gen AI use cases</b></p> <p><i>Q: Which of the following metrics are most important in terms of justifying your organization’s generative AI business cases? (Percent of respondents naming each as a top-three choice)</i></p>

#

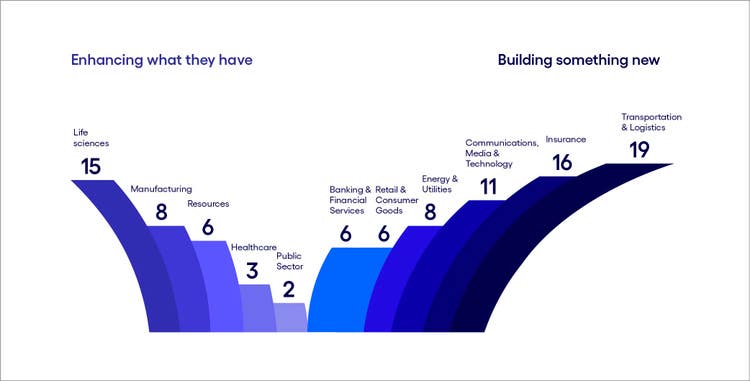

<p><span class="small">Base: 100 senior business leaders in France<br> Source: Cognizant and Oxford Economics<br> Figure 5</span></p> <p>Using this more granular view of productivity goals and business drivers, we analyzed the differences in how industries intend to use the technology.</p> <p>Rather than focusing on the distinction between productivity vs. innovation, we grouped the metrics into two high-level categories of business use cases:</p> <ul> <li><b>Enhancing current business performance </b>(revenue, cost savings, time-to-market, productivity)<br> <br> </li> <li><b>Building something new</b> (new revenue sources, new or improved products, innovation)</li> </ul> <p>We then assigned each of the metrics a score to see the relative gap between a number-one-ranking metric and a number-three-ranking metric. By calculating the average score across industries, we could clearly see how each industry’s responses deviated from the baseline.</p> <p>Our analysis reveals stark differences among industries in terms of the business use cases they’ll likely prioritize (see Figure 6).</p> <p><b>Industries diverge on business cases</b></p>

#

<p><span class="small">Note: This figure depicts each industry’s relative deviation from a baseline of “zero,” using a ranked scoring of the top three metrics respondents cite as important for justifying their generative AI use cases. It reveals a weighted view of each industry’s overall priorities for gen AI deployment.</span></p> <p><span class="small">Base: 100 senior business leaders in France<br> Source: Cognizant and Oxford Economics<br> Figure 6</span></p> <p><b>The manufacturing sector </b>accounts for roughly <a href="https://tradingeconomics.com/france/manufacturing-value-added-percent-of-gdp-wb-data.html" target="_blank" rel="noopener noreferrer">10%</a> of France’s total GDP. The country is home to two major automobile manufacturing plants, Peugeot and Renault. While COVID-19 impacted many sectors, automobile manufacturing was hit particularly hard, with France at the helm of production losses, according to <a href="https://www.acea.auto/figure/interactive-map-covid-19-impact-on-eu-automobile-production-full-year-2020/" target="_blank" rel="noopener noreferrer">ACEA.</a> For this reason, productivity increases have been at the forefront of this sector’s focus with generative AI.</p> <p>Renault currently has over 300 operational applications of AI and is testing the use of generative AI to speed product engineering. Deployed at scale on multiple sites, this has allowed the company to increase both productivity and quality.</p> <p>Companies in the sector aren’t limiting their investments to productivity, however. Peugeot, for example, has announced it would integrate an AI-based chat function called <a href="https://www.media.stellantis.com/em-en/peugeot/press/peugeot-integrates-chatgpt-as-standard-across-its-entire-line-up" target="_blank" rel="noopener noreferrer">“Peugeot's I-cockpit"</a> via ChatGPT to help improve voice assistance across its vehicles.<br> </p> <p><b>The life sciences</b> sector is similarly focused on enhancing existing business performance. France intends to lead Europe in the field by 2030, as listed in the country’s <a href="https://www.biospace.com/france-eyes-growth-in-life-sciences-industry-aims-to-become-top-ecosystem-in-europe" target="_blank" rel="noopener noreferrer">Healthcare Innovation 2030 strategy</a>. French President Macron would like to harness France’s strong suits in schooling, research organizations, laboratories, healthcare, manufacturing and startup technologies to surpass other countries in the pursuit for the top. AI has helped many French companies pursue advancements at much faster rates.</p> <p>Sanofi recently announced its partnership with OpenAI and Formation Bio to accelerate drug development. The goal is to advance AI capabilities in drug development more quickly than one company alone could accomplish. Sanofi will utilize its proprietary data in combination with OpenAI’s AI capabilities and Formation Bio’s engineering resources and tech-forward dev platform. The final product will be automated AI-enabled programs and models tailored explicitly for pharma needs.<br> </p> <p>Startup <a href="https://www.bpifrance.com/2023/05/30/healthtech-french-companies-tap-into-data-and-ai-to-become-world-leaders-in-medical-innovation/" target="_blank" rel="noopener noreferrer">Incepto</a>, meanwhile, utilizes AI to improve diagnosis, and speed up detection and interpretation. Incepto develops and distributes more than 20 AI-based applications for medical imaging, with the aim of better allocating doctors’ and patients’ time between scans and readings in ERs and hospitals.<br> </p> <p><b>The transportation and logistics</b> sector, meanwhile, is focused on innovating traditional processes. Air France <a href="https://corporate.airfrance.com/en/news/how-air-france-using-artificial-intelligence-ai-optimize-its-business-activities-and-improve" target="_blank" rel="noopener noreferrer">is currently utilizing 80 gen AI projects</a> in various stages of deployment, including a tool for analyzing customer feedback sentiment and translating the results to relevant entities throughout the company. Another tool provides airline agents with answers and templated responses to customer questions in 85 languages by searching through manuals and procedure documents.<br> </p> <p><b>The insurance sector </b>is similarly focused on<b> </b>innovation. For example, insurer AXA enables all of its employees to use <a href="https://news.europawire.eu/axa-launches-axa-secure-gpt-an-internal-secure-ai-platform-for-employee-use/eu-press-release/2023/07/28/10/19/15/119576/" target="_blank" rel="noopener noreferrer">AXA Secure GPT</a> to generate, summarize, translate and correct text, images and code. This approach of employing AI for all is viewed as democratizing the technology for broader usage than typically seen before.</p>

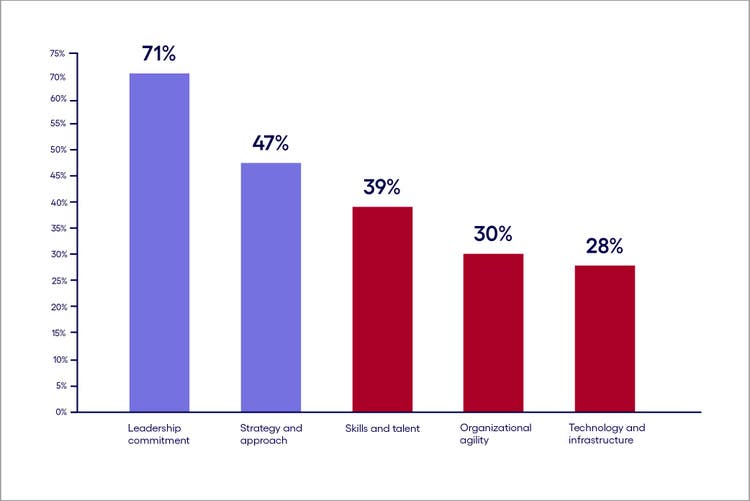

<h4>Business constraints: Talent shortages and shaky technology foundations</h4> <p>A remaining question is whether businesses are ready to drive real value from these business cases.</p> <p>The answer, according to our research, is mixed. To better understand how prepared executives believe their business is to adopt generative AI, we asked respondents to rank their organization’s maturity on a scale of 1 to 4 by selecting a statement that best described their organization in the following five areas, from low maturity to high:</p> <ul> <li>Organizational agility</li> <li>Leadership commitment</li> <li>Skills and talent</li> <li>Strategy and approach</li> <li>Technology and infrastructure</li> </ul> <p>The message from business leaders is evident: Leadership commitment is high, and strategies are robust. However, the fundamental technological building blocks and organizational agility necessary to adopt the technology are lacking (see Figure 7).</p> <p><b>Leadership support is sound, but fundamentals are lacking</b></p> <p><i>Respondents were asked to rate the maturity of their organization's operations in relation to generative AI. (Percent of respondents rating each as a 3 or 4, with 4 representing the highest level of maturity)</i></p>

#

<p><span class="small">Base: 100 senior business leaders in France<br> Source: Cognizant and Oxford Economics<br> Figure 7</span></p> <p>While data quality is rated high (50% rate it as good or excellent), many other foundational aspects are lacking. These include the ability to comply with company rules or policies and frameworks, data accessibility, and compliance with customer privacy and contracts. All of these compliance capabilities achieved the lowest two ranks by the majority of respondents.</p>

<h4>Path to success: Strategic recommendations for French businesses</h4> <p>The challenge ahead is to take full advantage of the factors that could encourage gen AI strategy success while overcoming the inhibitors.</p> <p>To navigate these challenges, executives should prioritize the following actions:</p> <ul> <li><b>Seek out government grants and subsidies: </b>There is a discrepancy between the optimism of French respondents for utilizing AI and the amount of money they’re investing toward its adoption. This disconnect is incongruent with the national investment being made in AI development.<br> <br> Government funding could accelerate AI development across the country. Currently, just over one-fifth of respondents said they would utilize grants to fund generative AI initiatives, and one-fourth would utilize joint ventures or sources of external funding.<br> <br> However, the central subsidy that benefits tech companies is the research tax credit, offering incentives ranging from 30% to 60% in R&D expenses, including employee salaries. While extremely helpful, the credit also contains a considerable drawback regarding the high-powered circuits that are foundational to the training of AI models: graphics processing units (GPUs). Companies that purchase GPUs receive the upper end of the incentive at 60%. But if they rent GPUs from a cloud provider, the subsidy does not apply.<br> <br> One significant inhibitor for companies purchasing GPUs is the cost of electricity in France, begging the question for many businesses whether the tax credit is worth the energy bill. If the government revamped the tax credit credentials to be independent of a company's GPU setup, it would help catapult innovation while upping business productivity and development.<br> <br> </li> <li><b>Facilitate streamlined visa processes for tech talent:</b> To bridge the talent gap, businesses in France will need to continue streamlining relocation processes for highly qualified international talent to the country via expedited visa programs. Ensuring that eligible talent can easily relocate to France is pivotal to providing the skilled talent needed to catapult the country into the AI hub it desires to be. Indeed, 39% of respondents say they would like to see employee sponsorship to support retraining and reskilling efforts.<br> <br> But beyond this, businesses in the region recognize they’ll need support from external experts, with 49% of respondents looking to partner with consultants on AI. The aim here, given the speed of change and the myriad hurdles to overcome, is to find a pragmatic partner that can help leapfrog challenges, assume risk and transform the business, enabling them to become truly ready to face the future.<br> <br> </li> <li><b>Invest in AI literacy and training</b>: While 53% of respondents plan to implement upskilling programs for employees in specific roles, only 25% plan organization-wide training programs. This is short-sighted. Comprehensive training programs can bridge the skills gap and encourage adoption, facilitating the integration of AI into existing operations and the development of new business models.<br> <br> Continued investment in the country’s <a href="https://www.researchprofessionalnews.com/rr-news-europe-france-2024-5-french-ai-clusters-up-and-running-with-360m-to-play-with/#:\~:text=The%20French%20government%20has%20allocated%20%E2%82%AC360%20million%20over,been%20allocated%20%E2%82%AC2.2%20billion%20for%202023%20to%202028." target="_blank" rel="noopener noreferrer">AI clusters program</a> will further develop the national training facilities and research centers of excellence needed to drive growth and competitiveness.<br> <br> </li> <li><b>Prepare operations for generative AI</b>: Most French respondents in our study expect generative AI to make an impact in less than five years. This provides business leaders with a window of opportunity to mature their technological foundations and operating models, as well as refine processes and workflows to accommodate AI-driven innovations.<br> </li> </ul> <p><i>*The full list of regional factors we evaluated includes: the flexibility of the existing operating model, market demand for gen AI-enabled products and services, data readiness, quality of output from gen AI, availability of compute power, cost/availability of gen AI-related technologies, shareholder/investor sentiment, regulatory environment, sustainability, national infrastructure, cost/availability of capital, data privacy and security, existing technology infrastructure, current and prospective employee perceptions, flexibility of the existing business model, maturity of gen AI-related technologies, consumer perceptions and cost/availability of talent.</i></p> <p><i>** Company examples mentioned in the report are from publicly available sources</i></p> <p><i>Learn about the impact of generative AI on jobs and the economy in our report </i><a href="https://www.cognizant.com/us/en/gen-ai-economic-model-oxford-economics" title="https://www.cognizant.com/us/en/gen-ai-economic-model-oxford-economics" target="_blank" rel="noopener noreferrer"><b><i>New work, new world</i></b></a><i>.</i></p>

Table of contents

Introduction #spy-1

Inhibitors and accelerators: The forces driving AI momentum #spy-3

Sector spotlight: Stark differences in industries’ gen AI adoption priorities #spy-4

Business constraints: Talent shortages and shaky technology foundations #spy-5

Path to success: Strategic recommendations for French businesses #spy-6

<h5>Authors</h5>

<p>Abid Samali is a seasoned professional with over 25 years of experience in the data and financial services sector. He specializes in driving responsible, AI-powered, and data-first adoption across various industries.</p>

<p>Alexandria Quintana is a Senior Manager at Cognizant Research. With experience managing and deploying data-driven projects across diverse industries, she integrates research and marketing to curate insightful thought leadership pieces.</p>