June 17, 2024

How insurers can act on the sustainability imperative

In our recent research, insurers align sustainability with business growth. However, they face challenges in realizing that vision. Here are three actions they can take to close the sustainability gap.

To the untrained eye, insurance might seem like one of the least impactful industries when it comes to improving business sustainability. Insurers don’t have carbon-intensive manufacturing plants to tackle, they don’t intensively use precious natural resources, and they don’t operate with complex supply chains of partners whose emissions need to be analyzed and abated.

What they do have, though, is a long and continued history of underwriting and investing in the fossil fuel sector. According to recent research, insurers still have over half a trillion invested in fossil fuel businesses. What’s more, the number of insurers adopting oil and gas restrictions has slowed in recent years. While 26 insurers globally have announced such restrictions, that still represents just 19.6% of all insurers—and just a slight uptick from 15.4% in 2022.

At the same time, in our recent study, a majority of insurers (65%) rank sustainability as having high or very high importance within their overall business strategy. The global study, conducted in partnership with Oxford Economics, surveyed 3,000 senior executives, including 295 from the insurance industry. (For the full study, see “Deep Green: how data, technology and collaboration will drive the next phase of sustainability in business.”)

It’s clear why sustainability is a strategic priority: With climate issues escalating, insurance payouts for climate-related disasters have doubled in the past 10 years, according to some estimates. Global economic losses from natural disasters mounted to $275 billion in 2022, and according to SwissRe, insurers were on the hook for $125 billion, or 45%, of the losses. By the first half of 2023, Aon reckons global economic losses from natural disasters already totaled $194 billion, of which only 27% was covered by insurance.

Some insurers are taking action to address the problem directly through their portfolios via risk prevention teams and underwriting criteria. Chubb recently announced a greener underwriting criterion for oil and gas projects that requires clients to reduce methane emissions, as well as promising not to provide insurance coverage for oil and gas projects in government-protected conservation areas.

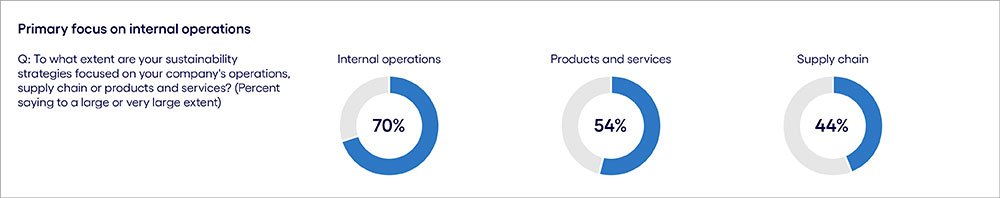

In our survey, the vast majority of insurers (86%) were aware of the importance of including climate risk factors in their sustainability strategies—yet a disconnect still exists in closing the sustainability gap across the industry. A closer look at insurers’ sustainability activity reveals insurers have so far mainly focused on the “quick wins” that can be gained from their own internal operations rather than the more difficult work of making their products and services more sustainable (see Figure 1).

Base: 295 insurance executives

Source: Cognizant and Oxford Economics

Figure 1

How insurers can get to the next sustainability step

To move beyond these internal initiatives, insurers need to face a perfect storm of competing priorities. The truth is, in the unfolding narrative of the earth’s changing climate, the insurance industry stands at a crucial juncture, facing challenges that go beyond boardrooms and policy documents. They appear to be pressured politically, economically and geopolitically to stick close to the status quo.

The recent news around the insurers’ climate alliance losing nearly half its members since last summer paints a vivid picture. Formed in 2019 to encourage commitment to net zero emissions by 2050 across their underwriting portfolios, the Net-Zero Insurance Alliance (NZIA) saw departures from some of the biggest names in global insurance (Swiss Re, Allianz, Munich Re, Axa, Lloyd’s). The exits follow pressure from US lawmakers who have accused insurers of advancing an “activist climate agenda.”

Further, unforeseen political events are impacting the movement from non-renewable to renewable energy. Germany, for example, took measures to reactivate coal-fired power plants following the Russian invasion of Ukraine.

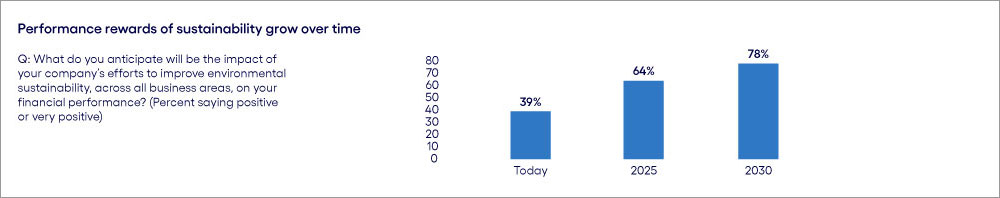

At the same time, according to our survey, insurers envision sustainability becoming a big part of their growth strategy. While today, over 60% of respondents believe sustainability initiatives will have either a neutral or somewhat negative impact on their financial performance, that shifts as time goes on. By 2030, 80% think they’ll see either a positive or very positive impact (see Figure 2).

Base: 295 insurance executives

Source: Cognizant and Oxford Economics

Figure 2

Realizing this vision will mean overcoming key underlying challenges with measures that are very much within insurers’ control. Doing so will help insurers shift toward a more sustainable—and successful—way of doing business.

#1 Insurer partnerships could unlock opportunities in renewables

As insurers look to embrace renewable energy across their portfolios, they face many obstacles to doing so. One is lack of expertise. With a rich history of serving the fossil fuel industry, experience is high when it comes to policy design specifications and statistical records—and low when it comes to renewables and the risks green energy projects entail.

Even with pressure from shareholders, governments and consumers, most insurers lack the necessary strategies, know-how and incentives to move toward renewable energy. In our study, the greatest challenges named are a lack of strategic alignment and clarity. Respondents also said they lacked the talent to see the strategy through (see Figure 3). To solve the talent challenge, 94% plan to train and upskill employees, and 83% plan to fill the gaps with partners or external hires.

Base: 295 insurance executives

Source: Cognizant and Oxford Economics

Figure 3

Partnerships can also help overcome this gap in knowledge and support the development of an ecosystem that can more readily respond to new and unpredictable risk factors. For example, insurers can become active in data exchanges with government bodies to holistically assess and remediate risk.

Munich Re has attempted this in partnership with the African Trade Insurance Agency to create the African Energy Guarantee Facility (AEFG), which could unlock USD $1.4 billion in clean energy investment in Africa by providing coverage against certain political risks.

Until now, the commercial insurance market hasn’t shown much appetite for long-term political risk protection in Africa’s energy sector. This has discouraged private investment from businesses that remain wary of political unrest in many of the continent’s nations. By insuring against political risks such as expropriation and breach of contract, currency inconvertibility, war, civil unrest and default on arbitration awards, the AEFG hopes to increase private participation in clean-energy projects.

Managing general agents (MGAs) also present themselves as valuable prospective partners. MGAs are specialized insurance agents that are authorized to conduct underwriting on behalf of insurers. Through partnership, insurance carriers can enter new markets without having to invest in entirely new internal infrastructures. MGAs can offer underwriting sophistication and experience for new lines of climate-related business.

Climate-focused MGAs such as Skyline Partners are emerging, and large incumbent insurers are actively investing in the space. For example, FutureProof Technologies, the climate-smart P&C insurtech, announced that it has raised $6.5 million in capital led by investment from AXIS Digital Ventures. This trend will only continue as the size and scale of the corporate climate services opportunity becomes more widely and better understood.

#2 New renewable-energy technologies present a challenge—and new ways to assess risk

The technology required to support renewable energy projects can be another inhibitor to insurers’ ability to underwrite them.

Intense competition has led to rapid advancements in the technology, materials and manufacturing methods offered by renewable-energy manufacturers. However, their relative newness can also work against them when it comes to insuring these businesses. This is because insurers can only fairly evaluate the practicality and longevity—and therefore the exposure and risk—of these technologies after they have been used for "approximately 8,000 hours, at scale," and in various environments.

Consider wind farms as an example. As wind turbines get larger and more efficient, they also become more vulnerable to lightning strikes and malfunctions due to freezing temperatures. Manufacturers have devised remedies, including rotor heating technology and lightning protection methods. But while these advancements make it possible for turbines to function more effectively in unfavorable conditions, their increased complexity comes with novel and unidentified risk exposures, usually with a lack of data to price them.

Repair costs are another coverage issue, especially with the growing scale and technological complexity of renewable energy installations. According to a GCube Insurance report, larger turbines—such as the frequently deployed 8 megawatt giants—are more prone to component failures. The report found that turbines sized 8MW or greater suffer component failures in the first two years of operation and accounted for 55% of all turbine insurance claims. New technologies require consistent technical evaluation and underwriting expertise—and for risk consultants, engineers and eventually underwriters, staying up to date with international technical standards and certifications becomes increasingly difficult as technology advances.

Energy providers are proactively introducing new technology to help manage losses. A week after nixing two offshore wind projects in New Jersey due to financial and supply chain issues, Danish energy giant Ørsted is doubling down on its land-based portfolio in the US. The company said it is rolling out a suite of artificial intelligence and machine learning tools aimed at increasing energy production, decreasing maintenance costs and improving operational efficiency across wind, solar and storage assets.

Insurance companies are similarly looking to technology to support more frequent remote assessments and improved maintenance schedules. Tokio Marine Kiln, a global specialist insurer, uses drones to assess damage during large natural catastrophe events, such as wildfires and hurricanes, when loss adjusters are unable to physically access these areas. The analysis also helps to manage potential bottlenecks in supply chains by pre-empting the need for replacement parts. These measures can reduce repair and replacement costs, and lower business interruption losses.

#3 Innovation is required to de-risk impact of climate factors and improve resilience

Developing products and solutions that cover increased risk while also mitigating potential loss is imperative for the insurance industry. Over their lifetime, renewable energy plants always confront a variety of changing risks. These include supply chain difficulties and other delays during construction, engineering problems during the early phases of project development, and operational risks once the project is put into motion.

A lack of historic data around extreme weather events has resulted in projects being built in locations more susceptible to hazardous weather than previously expected, increasing losses for both wind and solar. Over the last 10 years, insurers have paid large claims related to property damage and revenue loss to wind farms, several of which had a claim value more than the amount paid in premiums.

As the risk associated with natural catastrophes become increasingly complex and unpredictable, one way the insurance industry has started to offset risk is by using multiyear parametric policies that offer more dependable, cost-effective coverage. Parametric insurance solutions, which cover the probability of a predefined event happening instead of indemnifying actual loss incurred, offers a level of risk transfer that helps make renewable energy projects financially viable.

With parametric insurance, specially designed weather stations are set up on-site to enhance data collection related to weather. Based on the more precise data, parametric solutions are then computed, with payouts linked directly to wind speed. As a result, parametric solutions are adaptable, clear and provide prompt payouts that could help the finances of renewable projects.

The demand for parametric solutions is already heating up. According to Swiss Re, the global parametric industry generated USD $11.7 billion in 2021, and this could rise to USD $29.3 billion by 2031. This solution also solves one of the most important problems facing the sector: response time. Parametric insurance cuts reaction times from months to a matter of days, and in some cases, even hours.

It’s no surprise then, that large insurers are doubling down in the space. AXA Group, for example, launched AXA Climate, a specialist weather, climate and parametric risk transfer unit. And recently announced a fresh partnership with catastrophe modeling, climate analytics and data specialist Reask, with a goal to make parametric risk transfer for cyclones faster and more accurate.

Innovation is also starting to heat up through government-backed sustainability initiatives. The Flood Re insurance initiative in the UK, a joint initiative between the government and insurers, aims to promote the availability and affordability of flood insurance to those who own properties in high-risk flood areas. The initiative—the first of its kind—allows insurance companies to pass on the risk of flood-prone properties by recovering claim costs through Flood Re.

Realizing the sustainability opportunity in insurance

Through partnerships, technology and product innovation, it’s clear there are several areas of opportunity for insurance companies to explore as they develop their sustainability strategy. By seizing these opportunities, they’ll realize the benefits of operating sustainably, from shareholder and stakeholder satisfaction, to meeting the increasing demand for coverage in renewable energy industries.

By addressing challenges through new approaches, insurers can move from the outskirts of the sustainability imperative to the center of the action.

Learn how your business (or you) can become sustainable to the core in our report, “Deep Green: How data, technology and collaboration will drive the next phase of sustainability in business.”

Latest posts

Related posts

Get actionable business Insights in your inbox

Sign up for the Cognizant newsletter to gain actionable AI advice and real-world business insights delivered to your inbox every month.