<p><br> <span class="small">February 17, 2025</span></p>

Japanese businesses can unleash gen AI by addressing top inhibitors

<p><b>Our research shows that Japan, one of the world’s most advanced economies, must grapple with critical inhibitors to realize the benefits of generative AI.</b></p>

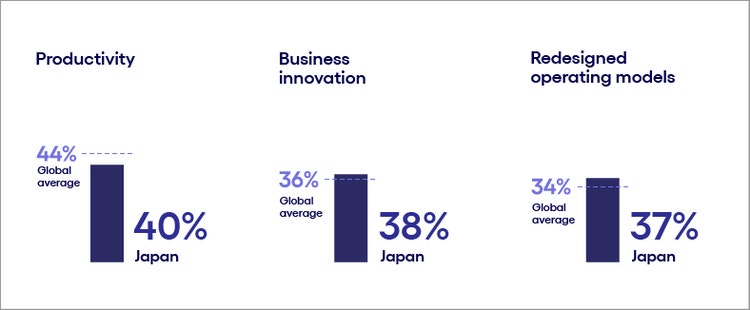

<p>Japan is widely regarded as one of the most technologically advanced countries in the world. The region excels in implementing well-established and tested technology across various industries and businesses.</p> <p>However, it also tends to be more conservative when it comes to pioneering immature technologies and is generally less inclined to take on the associated risks. This cautious approach minimizes the chances of failure in adopting cutting-edge innovations.</p> <p>Moreover, Japan traditionally takes pride in its “<i>monozukuri</i>” culture, which emphasizes the creation of physical and tangible products over intangible ones. This cultural focus manifests in the country’s strengths in infrastructure, manufacturing and robotic automation. At the same time, Japan receives considerably less recognition in software development and digitization. Consequently, while Japan leads the field of robotics, it lags behind in areas such as AI integration.</p> <p>This might explain why, when it comes to generative AI, while businesses believe this technology is critical to their future success, they plan to invest just under $23 million this year, less than half the global average of $47 million. A clear majority (63%) of Japanese respondents believe their companies aren't moving fast enough with their generative AI strategies, and over half (58%) believe these delays will result in a competitive disadvantage.</p> <p>To better understand what generative AI adoption will look like globally, we conducted a study of 2,200 business leaders in 23 countries and 15 industries, including 200 in Japan. The study assessed a wide range of generative AI adoption trends, including investment levels, use cases, how critical gen AI strategies are to business success and organizational readiness to adopt the technology.</p> <p>Advancement of corporate AI strategies and capabilities in Japan is especially critical given that companies are grappling with an aging population and shrinking workforce. To encourage investment and nurture the local AI ecosystem, the government is favoring a lighter regulatory approach, distancing itself from stricter global regimes and forging strategic partnerships that could help speed adoption and scale use.</p> <p>As part of our study, we looked at two distinct uses of the technology: productivity, such as helping people work more quickly and get more done, and disrupt-the-business innovations, which involve more sweeping change to business and operating models. Overall, Japan mirrors the global trend: Over the next two years, more respondents expect to use generative AI to boost productivity than drive innovation (see Figure 1).</p> <p>At the same time, executives in Japan also exhibit a lower-than-average commitment to productivity and a higher-than-average commitment to both business innovation and redesigning operating models. This reflects the region’s track record of embedding new technologies directly into their business.</p> <p><b>Greater focus on productivity than innovation</b></p> <p><i>Q: Which of the following best describes the role generative AI will play in your organization's business strategy in the next two years? (Percent of respondents naming each as a top-3 choice)</i></p>

#

<p><span class="small">Base: 200 senior business leaders in Japan<br> Source: Cognizant and Oxford Economics<br> Figure 1</span></p> <p>Our study also reveals a change in what productivity means when pursued with generative AI. The end goal is not efficiency and cost-cutting as has been the case with previous automation endeavors. This new dynamic requires fresh thinking around understanding business use cases of generative AI, which we’ll address later in this report.</p> <p>This report identifies the regional and business factors that could either inhibit or accelerate generative AI momentum in Japan. It also provides an industry-specific look at how generative AI will be used, a regional focus on business readiness and strategies to successfully implement generative AI in this country.</p>

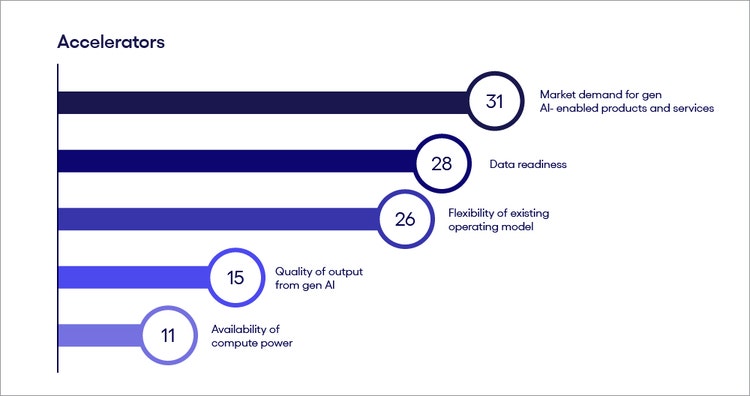

<h4><br> Inhibitors and accelerators: The forces driving AI momentum</h4> <p>In our study, we analyzed 18 regional and internal business factors that will either inhibit or accelerate business adoption of gen AI (see the end of the report for the full list of factors). Respondents evaluated each factor’s potential impact on their generative AI strategy, rating it as either positive or negative on a scale of high to low impact.</p> <p>With this assessment, leaders can take advantage of what’s working well in their local environment, while strategizing on overcoming challenges. </p> <p><b>A look at Japan’s gen AI accelerators</b></p>

#

<p><span class="small">Respondents were asked which factors inhibit or accelerate their organization's adoption of generative AI. Score represents a percentage point difference to the country's momentum score compared to the global baseline.<br> Base: 200 senior business leaders in Japan<br> Source: Cognizant and Oxford Economics<br> Figure 2</span></p> <p>The greatest driver for gen AI in Japan is <b>market demand. </b>Businesses in this country have a strong track record of adopting automation technologies to boost productivity and mitigate the impact of demographic shifts. The region has a particularly robust history of embedding robotics across a broad range of industries, including manufacturing, logistics, food and pharmaceuticals. For example, in the manufacturing sector alone, <a href="https://www.tntra.io/blog/robotics-revolution-japan-future-of-work/#:\~:text=In%20the%20manufacturing%20sector%2C%20Japan,US%20for%20every%2010%2C000%20people." target="_blank" rel="noopener noreferrer">there are 631 robots for every 10,000 workers</a> in Japan, compared with just 274 per 10,000 in the US.</p> <p>Japanese businesses are also positive about their organizations’ internal ability to leverage generative AI. They have a rosy view of their <b>data readiness</b> and the <b>flexibility of their operating models</b>, even as many recognize there is more work to do.</p> <p>According to our survey, 54% of Japanese businesses believe they have good or excellent data quality and cleanliness. However, only 16% believe they have adequate data security, and 12% flag concerns with compliance, underscoring the need for a comprehensive data strategy to ensure safe, effective and scalable use of this technology.</p> <p>Optimism about the <b>quality of output</b> is also pushing adoption forward. This is evident in the wide range of use cases businesses in the region are already exploring with this relatively nascent technology. According to our data, 52% of businesses are already piloting solutions that will add a new revenue source. In addition, 47% have pilots to write and test software code, with 21% advising they are already in full deployment.</p> <p>The <b>availability of compute power</b> in the region is also viewed as a boon to adoption. Japan has a robust cloud infrastructure, and is now attracting considerable additional investment. <a href="https://technologymagazine.com/articles/aws-upping-japan-cloud-infrastructure-with-15bn-investment" target="_blank" rel="noopener noreferrer">AWS plans to invest ¥2.26 trillion (US$15.24 billion)</a> in Japan by 2027 to expand cloud computing infrastructure in the country.</p> <p>In addition, Japan’s Ministry of Economy, Trade and Industry also <a href="https://blogs.nvidia.com/blog/japan-sovereign-ai/" target="_blank" rel="noopener noreferrer">announced plans to invest $740 million</a> with AI leader NVIDIA and six local firms to bolster the country’s generative AI infrastructure and elevate Japan’s sovereign AI efforts. Through this investment, the Japanese government is aiming to accelerate AI adoption by subsidizing the cost of constructing AI supercomputers, improving workforce skills and advancing Japanese language model development.</p> <p><b>Understanding Japan gen AI inhibitors</b></p>

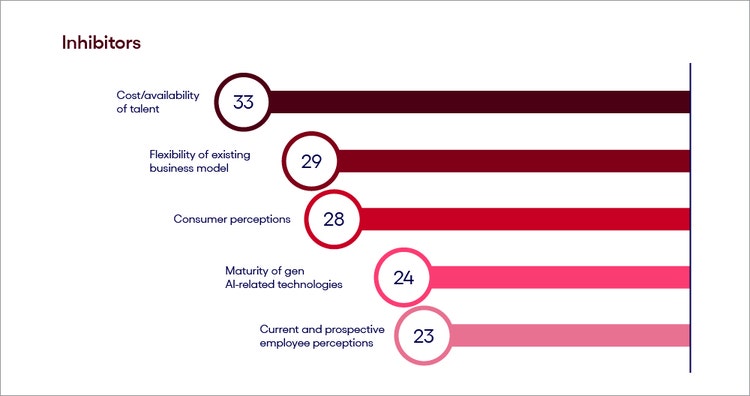

#

<p><span class="small">Respondents were asked which factors inhibit or accelerate their organization's adoption of generative AI. Score represents a percentage point difference to the country's momentum score compared to the global baseline.<br> Base: 200 senior business leaders in Japan<br> Source: Cognizant and Oxford Economics<br> Figure 3</span></p> <p>The <b>cost and availability of talent</b> is the greatest inhibitor to adoption in Japan. At a macroeconomic level, Japan’s shrinking and aging population continues to put pressure on the labor market. While this factor is driving the adoption of automation technologies, it also expands the supply-demand gap between digital and AI-trained professionals. In addition, the region is known for its relatively high barriers to overcome in order for foreign talent to seamlessly assimilate into Japan—compounded by linguistic and cultural hindrances that are difficult to bypass.</p> <p>In the case of specialized skill sets, like those required to implement generative AI at scale, this challenge strikes harder. <a href="https://www.cnbc.com/2023/07/07/why-japan-is-lagging-behind-in-generative-ai-and-creation-of-llms.html" target="_blank" rel="noopener noreferrer">According to the Ministry of Economy, Trade and Industry</a>, Japan will have a deficit of 789,000 software engineers by 2030. To address this issue, the government launched plans to expand training opportunities for 110,000 students and working professionals to build digital skills in areas where there is a talent shortage, such as AI.</p> <p>Businesses in the region are also concerned about the <b>inflexibility of their business models</b>. This stands in stark contrast to respondents’ relatively positive view of their operating models. In effect, companies are concerned that new opportunities will emerge too swiftly for their business to pivot and meet them, a fact grounded in the 63% of respondents in the region who believe their organizations aren’t moving fast enough.</p> <p><b>Consumer perceptions</b> also raise concerns for businesses. While there are cultural arguments that Japanese consumers are more willing to engage with robotics and automation in a variety of contexts compared with other regions, the uptake of generative AI in the consumer space remains relatively low. <a href="https://asia.nikkei.com/Business/Technology/Artificial-intelligence/Japan-trails-China-U.S.-in-personal-usage-of-generative-AI-white-paper#:\~:text=TOKYO%20%2D%2D%20Only%209.1%25%20of,white%20paper%20released%20Friday%20shows." target="_blank" rel="noopener noreferrer">Only 9.1% of people in Japan use the technology</a>, compared with 56.3% in China and 46.3% in the US.</p> <p><a href="https://www.statista.com/statistics/1428305/japan-share-of-employees-who-feel-uneasy-about-future-because-of-generative-artificial-intelligence/" target="_blank" rel="noopener noreferrer">According to research</a>, this consumer adoption gap is also causing concern for employees. A survey conducted in late 2023 argued that 40% of white-collar employees feel uneasy about generative AI, while 30% are unsure.</p>

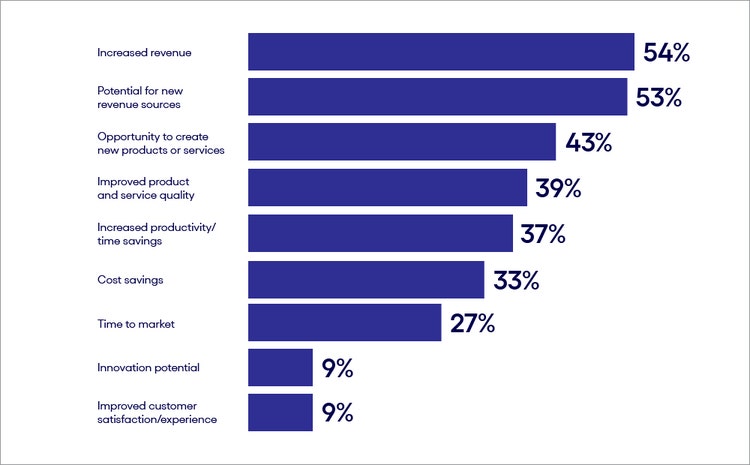

<h4><br> Sector spotlight: Stark differences in industries’ gen AI priorities</h4> <p>As noted above, Japanese businesses are primarily focused on realizing productivity gains with generative AI, at least in the next two years. However, a look at what’s driving their business cases sheds a new light on productivity from how it’s been seen historically.</p> <p>Traditionally, businesses have equated automation productivity gains with cost cutting: driving down the cost of output by reducing the number of people needed to get work done. While generative AI-driven automation will likely lower headcount to some degree, that is no longer the end goal. Instead, as seen through the metrics respondents will use to drive business cases, we see a shift toward redirecting productivity gains into funding endeavors that increase revenues or lead to entirely new revenue streams.</p> <p>The metrics Japanese respondents say will be most important for justifying generative AI expenditures include increasing revenues, discovering new revenue sources, and creating new products and services, all of which were cited as a top-three priority by 54%, 53% and 43% of respondents, respectively (see Figure 4). Conversely, metrics like cost savings and time-to-market were cited by just 33% and 27% of respondents, respectively. In other words, the concept of productivity no longer stops at cost cutting—businesses appear to be redirecting productivity gains into initiatives aimed at growth.</p> <p><b>Increasing revenue and driving down costs fuel gen AI business case justification</b></p> <p><i>Q: Which of the following metrics are most important in terms of justifying your organization’s generative AI business cases? (Percent of respondents naming each as a top-three choice)</i></p>

#

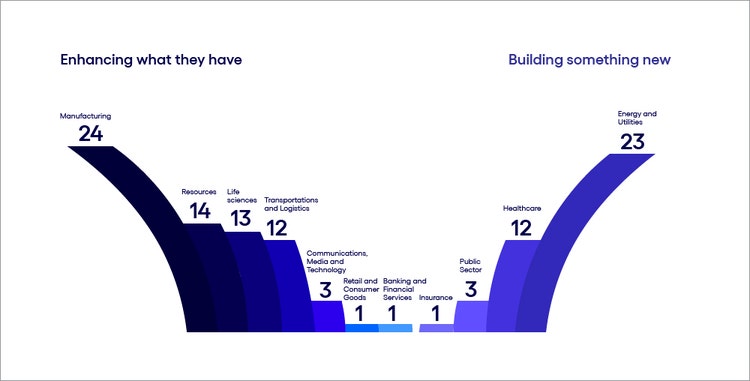

<p><span class="small">Base: 200 senior business leaders in Japan<br> Source: Cognizant and Oxford Economics<br> Figure 4</span></p> <p>Using this more granular view of productivity goals and business drivers, we analyzed the differences in how industries intend to use the technology.</p> <p>Rather than focusing on the distinction between productivity vs. innovation, we grouped the metrics into two high-level categories of business use cases:</p> <ul> <li><b>Enhancing current business performance </b>(revenue, cost savings, time-to-market, productivity)</li> <li><b>Building something new</b> (new revenue sources, new or improved products, innovation)</li> </ul> <p>We then assigned each of the metrics a score to see the relative gap between a number-one-ranking metric and a number-three-ranking metric. By calculating the average score across industries, we could clearly see how each industry’s responses deviated from the baseline.</p> <p>Our analysis reveals stark differences among Japanese industries in terms of the business use cases they’ll likely prioritize (see Figure 5).</p> <p><b>Industries diverge on business cases</b></p>

#

<p><span class="small">Note: This figure depicts each industry’s relative deviation from a baseline of “zero,” using a ranked scoring of the top-three metrics they cite as important for justifying their generative AI use cases. It reveals a weighted view of each industry’s overall priorities for gen AI deployment.<br> Base: 200 senior business leaders in Japan<br> Source: Cognizant and Oxford Economics<br> Figure 5</span></p> <ul> <li>The<b> manufacturing</b> sector in Japan is leaning heavily into enhancing existing processes. <a href="https://media.toyota.co.uk/toyota-research-institute-develops-new-ai-technique-with-potential-to-help-speed-up-vehicle-design/" target="_blank">Toyota, for example</a>, developed a new AI technique that will help accelerate vehicle and EV design. This capability, which allows designers to integrate initial design sketches and engineering constraints into text-to-image generative AI tools, will reduce the number of iterations during the innovation process.<br> <br> Meanwhile, <a href="https://asia.nikkei.com/Business/Companies/Panasonic-unit-deploys-ChatGPT-style-AI-to-improve-productivity" target="_blank">Panasonic is deploying a ChatGPT-style AI assistant to boost productivity</a>. The investment will enable all 12,500 employees in Japan to use the assistant for a range of tasks, such as drafting documents.<br> <br> The Mitsubishi Electric Corporation has <a href="https://www.mitsubishielectric.com/news/2024/0125.html" target="_blank">developed a behavioral-analysis AI</a> that assesses the efficiency of manual tasks from production site videos. The tool, which leverages a probabilistic generative model, analyzes the videos and provides recommendations for process improvement—all without requiring any model training.<br> <br> </li> <li><b>Life sciences companies </b>are also focused on enhancing what they have. <a href="https://www.takeda.com/our-impact/our-stories/ai-assistant/" target="_blank">Takeda Pharmaceuticals recently launched myAibou</a>, which means “my work collaborator” or “partner” in Japanese. This AI-enabled digital assistant can help employees write emails, create presentations and synchronize calendars. The firm is working to launch new capabilities for the tool that will focus on enhancing meetings, such as by accessing past transcripts and notes.<br> <br> More broadly, Mitsui and NVIDIA <a href="https://blogs.nvidia.com/blog/generative-ai-supercomputer-pharmaceutical-industry/" target="_blank">recently announced</a> Japan’s first generative AI supercomputer for the pharmaceutical industry. The supercomputer, Tokyo-1 NVIDIA DGX, will allow pharmaceutical companies to simulate molecular dynamics, train large language models, create novel molecular structures and launch quantum chemistry use cases. These developments are expected to help shorten both the drug development and approval cycles in Japan.<br> <b><br> The energy and utilities sector, </b>on the other hand,<b> </b>is far more likely to be focused on building something new. For example, Eneos, a petroleum company, <a href="https://www.eneos.co.jp/english/rd/research/digital/ai\_plant.html" target="_blank">is using AI</a> and a range of other technologies to develop automatic plant operations. The goal of this program is to offset a decrease in experienced human operators, while also raising production efficiency and enhancing energy-saving operations.<br> <b><br> The banking sector </b>is taking a more moderate approach, balancing both performance enhancement and innovation. Take Mizuho, a Japanese bank, <a href="https://www.fstech.co.uk/fst/Japan\_Mizuho\_bank\_rolling\_out\_generative\_AI\_to\_45000\_employees.php" target="_blank">which is rolling out generative AI functionality</a> to its 45,000 employees in Japan. Toshitake Ushiwatari, the general manager of Mizuho's digital planning department, has said all employees at its core lending units within Japan will test the service. Managers and C-suite employees have already begun submitting pitches on how to utilize the technology ahead of its rollout. One idea being considered is using generative AI as a one-stop reference point for the bank's vast guidelines around its internal rules and processes.</li> </ul>

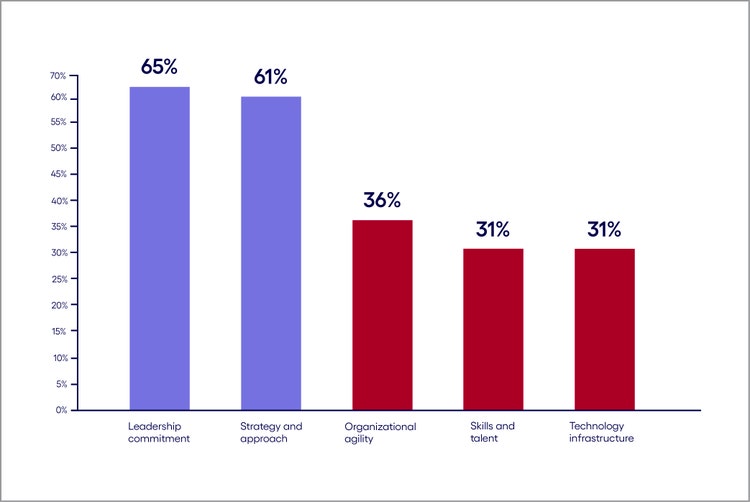

<h4><br> Business constraints: Talent shortages and shaky tech foundations</h4> <p>A remaining question is whether businesses are ready to drive real value from these business cases.</p> <p>The answer, according to our research, is mixed. To better understand how prepared executives believe their business is to adopt generative AI, we asked them to rate their organization’s maturity on a scale of 1 to 4 by selecting a statement that best described their organization in the following five areas, from low maturity to high:</p> <ul> <li>Organizational agility</li> <li>Leadership commitment</li> <li>Skills and talent</li> <li>Strategy and approach</li> <li>Technology and infrastructure</li> </ul> <p>The message from business leaders in Japan is evident: Leadership commitment is high, and strategies are robust. However, the fundamental operational and technological building blocks necessary to adopt the technology are lacking (see Figure 6).</p> <p><b>Leadership support is sound, but fundamentals are lacking</b></p> <p><i>Respondents were asked to rate the maturity of their organization's operations in relation to generative AI. (Percent of respondents rating each as a 3 or 4, with 4 representing the highest level of maturity)</i></p>

#

<p><span class="small">Base: 200 senior business leaders in Japan<br> Source: Cognizant and Oxford Economics<br> Figure 6</span></p> <p>Examining where the biggest challenges are, it’s perhaps unsurprising that businesses in the region believe the availability of skills and talent are cause for concern—given that talent also ranks as a major AI inhibitor. Japan businesses leaders are also marginally more pessimistic when analyzing their technology and infrastructure. Only 31% of businesses rank their tech estate in the top two levels of maturity, compared with a global average of 32%.</p>

<h4><br> Path to success: Strategic recommendations for Japanese businesses</h4> <p>While Japan faces clear challenges with respect to generative AI adoption compared with other regions analyzed, the country clearly has an appetite for the technology. In fact, 75% of respondents say that AI is important or critically important to their business success. The challenge ahead is to take full advantage of the factors that could encourage gen AI strategy success while overcoming the inhibitors.</p> <p>To navigate these challenges, executives should prioritize the following actions:</p> <ol> <li><b>Enhance data security and compliance</b>: Despite hailing from a region recognized as one of the most technologically advanced economies in the world, AI raises complex and unique concerns, particularly as it relates to data. Companies must develop strong data security and compliance functions, supported by a robust core infrastructure, to effectively scale the use of AI.<br> <br> </li> <li><b>Address talent shortages</b>: Businesses should collaborate with educational institutions and government agencies to address gaps within the digital workforce. This is a crucial step given that Japan, compared with other industrialized nations, tends to focus tertiary education on theoretical aspects of hard sciences, and provides less guidance on programming and software tools. Consequently, most students graduate lagging behind their US, Chinese and Indian counterparts in terms of programming skills. That said, the government and educational institutions are <a href="https://www.japan.go.jp/kizuna/2021/04/ict\_in\_schools.html" target="_blank" rel="noopener noreferrer">working to close this gap</a>.<br> <br> </li> <li><b>Leverage market demand for automation technologies</b>: Businesses should continue leveraging automation by integrating generative AI into their operations to enhance productivity and drive innovation. This includes investing in AI-driven tools and solutions that can streamline processes and improve efficiency.<br> <br> IoT technology could be attractive for helping Japanese industries enhance their traditional assets, thus providing strong grounds for advancing generative AI solutions. The inherent psychological barriers to adopting “vanilla AI” can be mitigated with the introduction of “hardware” IoT (which has been traditionally embedded into the fabrics of <i>monozukuri </i>culture) as a critical enhancer of generative AI technology.<br> <br> Adopting global shared services models and setting up regional delivery hubs would further allow Japan to accelerate its technology leadership and innovation. While this would require a mindset change, we are seeing examples of some of Japan’s largest manufacturing companies having success in setting up regional hubs to tap into technology and innovation (in addition to operations and manufacturing).</li> </ol> <p><i>*The full list of regional factors we evaluated includes: the flexibility of the existing operating model, market demand for gen AI-enabled products and services, data readiness, quality of output from gen AI, availability of compute power, cost/availability of gen AI-related technologies, shareholder/investor sentiment, regulatory environment, sustainability, national infrastructure, cost/availability of capital, data privacy and security, existing technology infrastructure, current and prospective employee perceptions, flexibility of the existing business model, maturity of gen AI-related technologies, consumer perceptions and cost/availability of talent.</i></p> <p><i>Learn about the impact of generative AI on jobs and the economy in our report </i><a href="https://www.cognizant.com/us/en/gen-ai-economic-model-oxford-economics" target="_blank" rel="noopener noreferrer"><i>New work, new world</i></a><i>.</i></p>

Jump to a section

Inhibitors and accelerators: The forces that shape AI momentum #spy-1

Sector spotlight: Stark differences in industries’ gen AI priorities #spy-2

Business constraints: Talent shortages and shaky tech foundations #spy-3

Path to success: Strategic recommendations for Japanese businesses #spy-4

<h5>Authors</h5>

<p>Ollie O'Donoghue leads Cognizant Research, leveraging over a decade of experience as an industry analyst and consultant. His primary focus is on understanding the impact of new economic and technological trends on businesses and industries.</p>

<p>Shinji Murakami is the head of Cognizant Japan, responsible for all aspects of country business. Shinji has more than 30 years of experience leading managed services, mobile communications, business development and go-to-market strategies in the IT industry. He joined Cognizant from Microsoft, where he was the Managing Executive Officer of the company’s Enterprise Group.</p>