The next step for challenger banks: prioritize open finance styles-h2 text-white

The next step for challenger banks: prioritize open finance

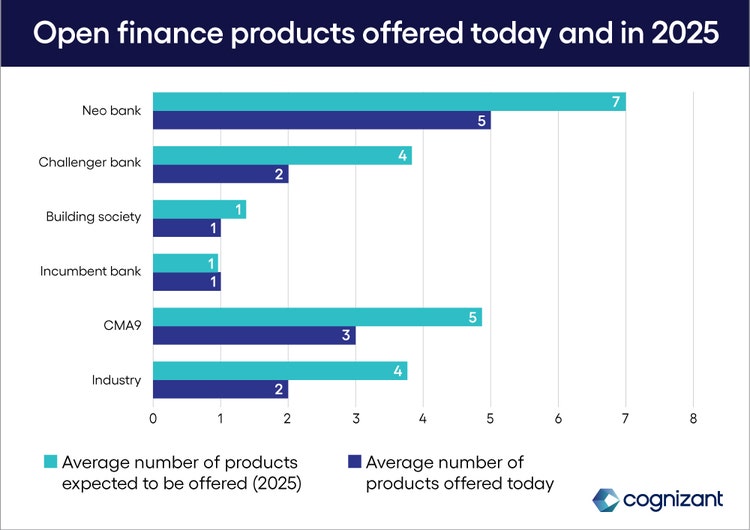

The past six months have seen a surge in dialog surrounding the purported value of “open finance” and whether or not its potential has been realized in the UK. We see open finance as the natural evolution of finance—a collection of standards, technologies and organizations that enables consumers to access reimagined credit, asset management, insurance and pension products with greater ease and transparency from a range of bank and non-bank suppliers.

While the debate has stoked critical thinking around what financial institutions can hope to achieve through open finance, large questions remain around the potential benefits still on the table.

To better understand how financial institutions are approaching open finance, between April and July 2022, we surveyed over 200 decision makers with responsibility for open finance within their organizations. Respondents were drawn from a representative cross-section of leaders from within the CMA9, building societies and incumbent, challenger and neo banks.

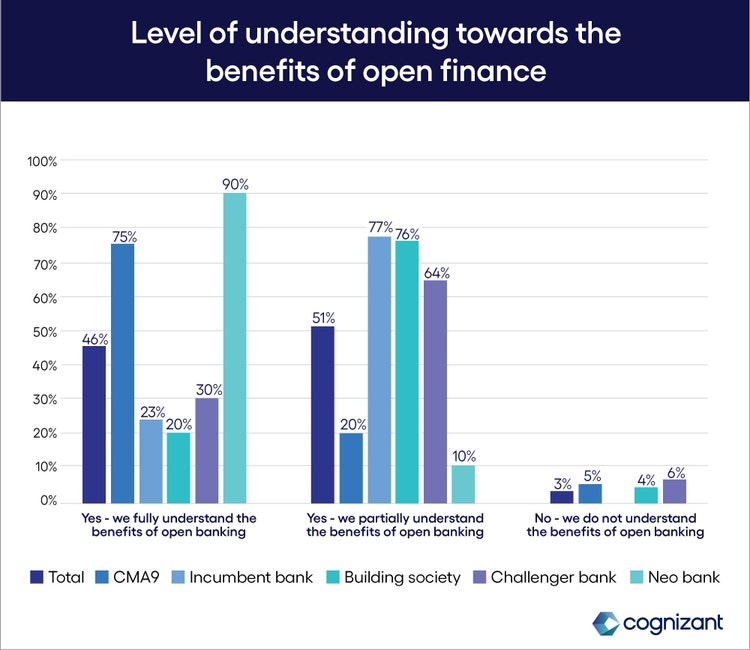

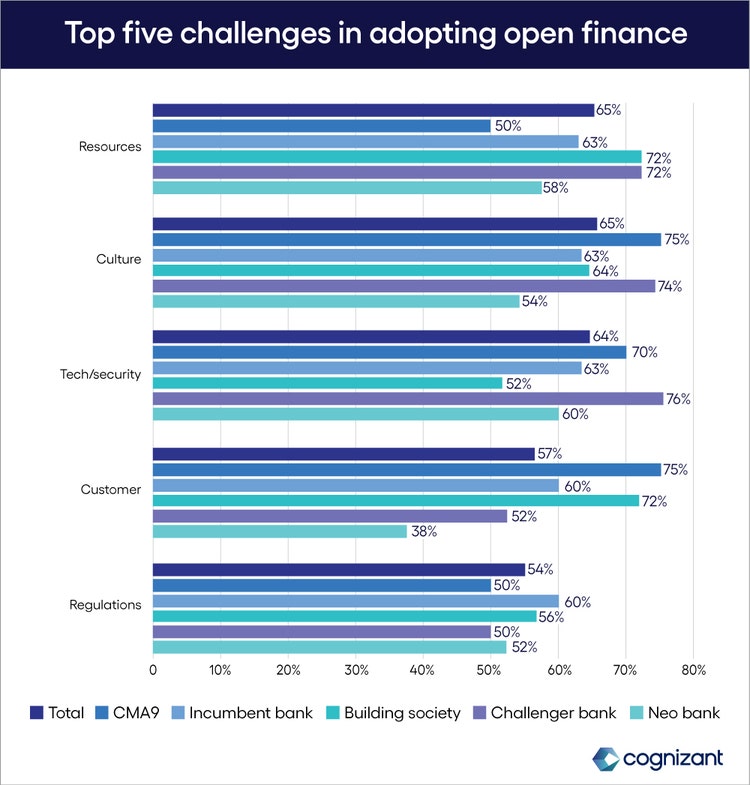

Through our research, we discovered a paradox in financial institutions’ approach to open finance. The paradox is two-pronged: First, there’s a marked inconsistency in the models that different financial organizations are using to align with the concept; second, business and investment priorities are frequently misaligned in areas where open finance could help institutions achieve their goals.

In this series, we explore the differing priorities, strategies and opinions among financial institutions to investigate the current state of play and the likely direction of travel—whether they’re confidently embracing open finance or reluctantly doing the bare minimum to comply with regulation.

“Huge customer financial data helps us provide more personalized services to customers. Traditionally, banks used to provide very limited services to their customers, but now with open finance, customer behavior can be predicted easily, and a wide array of services are provided. Innovating to provide the best services in one platform is the need of the hour.” – Director of Compliance, UK Challenger Bank

“As vital as it is to be successful, we also want to become a profitable and sustainable bank. To do this, we are deciding to join the Tech Zero Taskforce, a coalition of companies aiming to accelerate the transition to net zero. We are also improving our governance and risk management policies, which have always been our top priority.” – Director of Compliance, UK Challenger Bank

“We want our consumers to feel highly secure as we prioritize safety and security… Some areas, such as enhancing our governance and risk management policies, call for constant improvement.” – Director of Compliance, UK Challenger Bank